- Donald Trump has no intention of dismissing Jerome Powell.

- The White House’s decision to postpone tariffs on minerals has dealt a blow to precious metals.

When Donald Trump sneezes, the markets get a fever; when he is in a nice mood, they flourish. The US president’s statement that he has no plans to oust Jerome Powell has bolstered the US dollar. The White House’s decision to postpone tariffs on imports of critical minerals has caused precious metal prices to plummet. The Republicans’ words that Iran no longer plans large-scale executions of protesters cut off oxygen to oil.

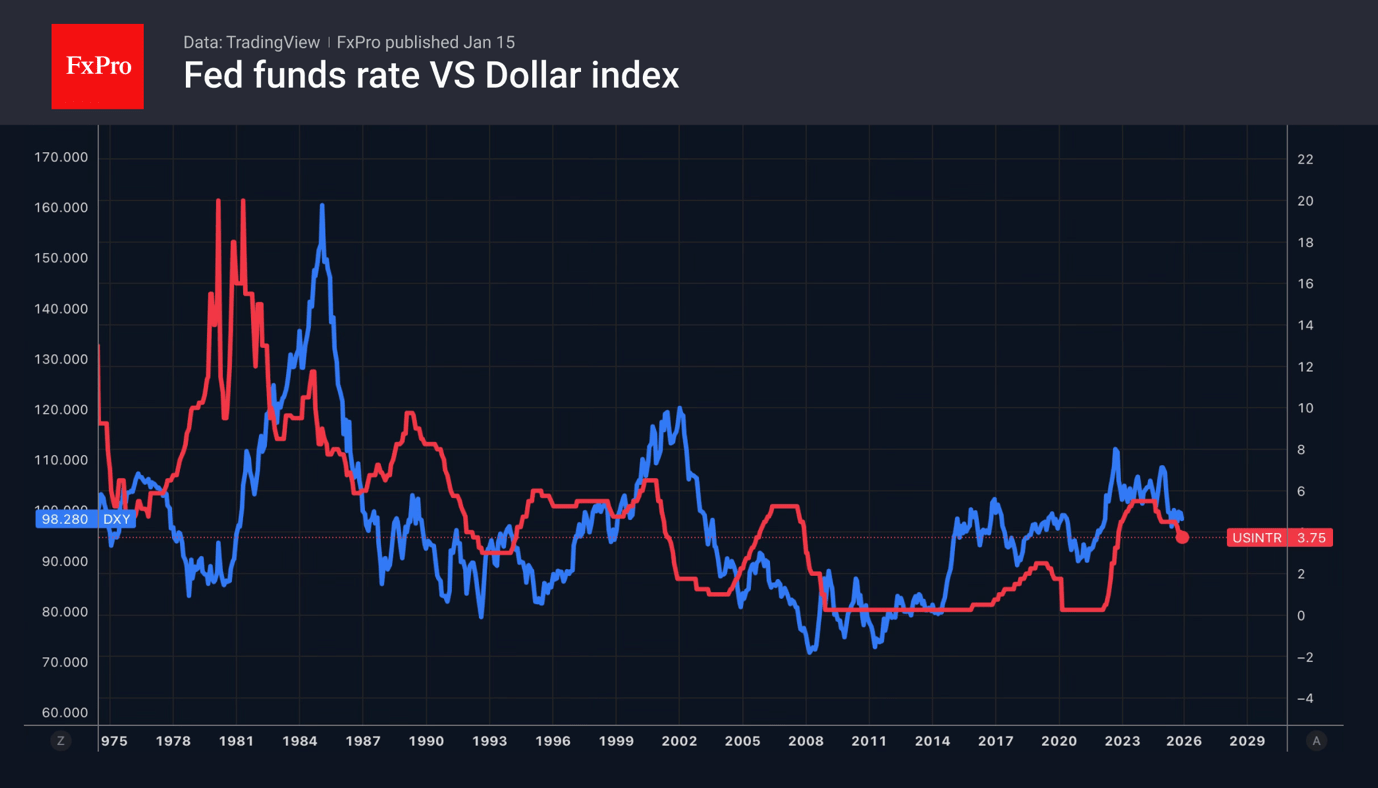

The Trump factor will undoubtedly manifest itself in the fate of the US dollar. However, this will most likely happen in the second quarter. The appointment of a new Fed chair and the replacement of FOMC governors with people loyal to the president will allow the composition of the Committee to be reshuffled and force the derivatives market to bet on aggressive monetary expansion. Until then, the EURUSD is likely to continue falling.

The US dollar is benefiting from a prolonged pause in the Fed’s cycle. The economy remains strong. This is confirmed by the acceleration of retail sales to 0.6% m/m in November. Inflation is slowing down, and producer price growth slowed to 0.1% in October and 0.2% m/m in November. The central bank can afford to sit back and watch how events unfold.

Meanwhile, passion surrounding the yen continues to run high. Japanese Finance Minister Satsuki Katayama said that the government will take appropriate measures against speculators on Forex, without ruling out any options. Similar statements were previously used by Tokyo immediately before currency interventions. Unsurprisingly, USDJPY bulls got scared and retreated.

US Treasury Secretary Scott Bessent noted the undesirability of excessive yen volatility and the need for sound monetary policy. He has repeatedly stated that USDJPY can be forced to fall by raising the overnight rate.

Precious metals took a step back due to the White House’s intention to postpone tariffs on imports of critical minerals. Fears over the introduction of tariffs were the catalyst for the transfer of bullion from Europe and Asia to the US. This resulted in a shortage of physical assets, which fuelled the rally in silver, platinum and palladium. Gold was less affected by Donald Trump’s decision.

The FxPro Analyst Team