On Friday, the markets were waiting for the G20 summit to end, and therefore were in no hurry to grow. So, by the end of the session, the Dow Jones lost 0.45%, the S&P500 sank by 0.30%, and the Nasdaq was in the red by 0.32%.

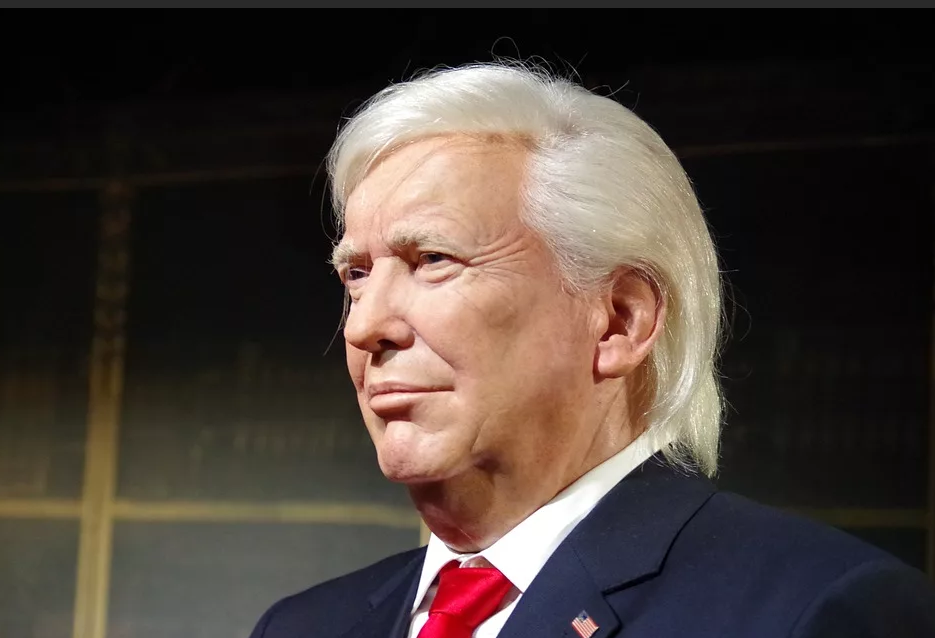

Formally, the negotiations have already ended but whether the actions of politicians will coincide with promises and agreements, we’ll see during the week. Meantime, stock markets are pleased with the positive outcome: no sharp statements on G20 were made, and the United States and China came to a certain consensus on Saturday. The presidents declared that they are resuming the dialogue on the “trade wars” and are considering the possibility of rejecting a new round of strengthening mutual tariffs. Trump also stressed that he was going to loosen sanctions against Huawei – news that was somewhat unexpected, and positively received by the markets as a result.

Furthermore, the China A50 opened the week with a gap up and is now trading at around 13962. The Dow Jones was also in with the similar outcome, showing a jump to 26863 at the beginning of the week.

FxPro analysts point out that there is a wary mood in the markets: investors are not sure that the Saturday dialogue on G20 will be able to stabilise the economic situation and ease the growing tension around the trade wars. But the uncertainty on the part of the Fed, in this case, is becoming a much stronger factor that will influence the US currency throughout the next week, while reducing the appetite for corporate spending.

Thus, the dollar sank on Friday after the Base personal consumption index rose by 0.2%. That confirmed the market’s expectations and was a weighty argument for the fact that the Fed will cut the rate from 2.5% to 2.25% in July. With the negative news of the US, the euro showed impressive growth in EURUSD, closing June with the strongest increase in the last 17 months.

Currently, the EURUSD is moderately declining, trading at around 1.1317. Following the positive news from the G20 summit, we are likely to see an upward trend again over the new five days. The course may push the end of June resistance at 1.1400, break through it and rush to 1.1464, or even 1.1527.

It is also worth bearing in mind the results of the negotiations between the President of Russia and the Crown Prince of Saudi Arabia on the oil issue. A preliminary agreement was reached on the extension of the OPEC + deal, which has had a positive impact on Brent on Monday: it has opened the session with a gap up, at $65.67 per barrel. A two-day OPEC+ meeting is now to set to begin, which will dot the i and conclude the final decision to be taken by the parties – including which documents will be signed. In light of this, volatility in the energy market will be increased.