U.S. stocks pushed higher for a fifth day, with sentiment getting a boost from corporate results and decent economic data. The euro edged lower. The S&P 500 matched its longest rally of the year, as stocks continued to rebound from the pre-Christmas rout. American earnings were mixed, with Alphabet slipping after announcing a big rise in spending, while Estee Lauder surged on its results. A reading on the services sector missed estimates but remained relatively high. Pemex bonds jumped after Mexico’s president said he’ll announce extraordinary measures to support the oil firm. Crude slumped.

The relative calm in markets belies an undercurrent of uncertainty as trade talks between the U.S. and China remain unresolved and America lurches toward another government shutdown. Investors will be watching President Donald Trump’s second State of the Union address later for any more signs of political rancor or clues on the outlook for foreign trade.

The Stoxx Europe 600 Index headed for the sixth advance in a row despite growth warnings from two chipmakers. Euro area PMIs were revised upward, helping boost sentiment further, but the common currency struggled as disappointing data from Italy hung over the region, while sterling fell following a weak services report.

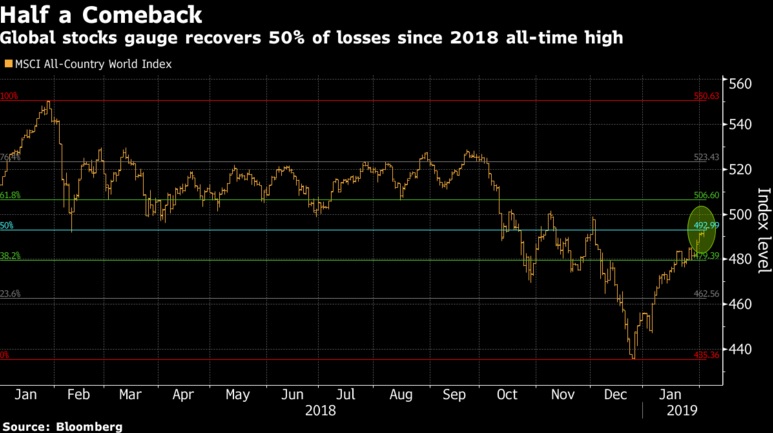

The S&P 500 Index gained 0.3 percent as of 10:10 a.m. New York time to the highest in two months. The Stoxx Europe 600 Index rose 1.1 percent, reaching the highest in 12 weeks on its sixth consecutive advance. The MSCI Asia Pacific Index rose 0.4 percent to the highest in almost four months. The MSCI Emerging Market Index increased 0.2 percent. West Texas Intermediate crude declined 1.1 percent to $53.97 a barrel.

U.S. Stocks Churn Higher; Bonds Rise as Oil Slumps: Markets Wrap, Bloomberg, Feb 05