Markets keep rallying. The US S&P500 is now in green zone year to date and Nasdaq in the proximity of 9900. The Dow Jones rally is comparable in strength to that seen in early 2018, according to RSI. Asian markets and European indices also support positive momentum.

The US employment report with a job increase by 2.5M shifted the attention of market participants to previously most beaten sectors. The stocks of the social distance beneficiaries – Amazon, Microsoft, and Apple are updating or close to their historic highs. However, the real rally on Friday and Monday was in Aviation and Banking sectors.

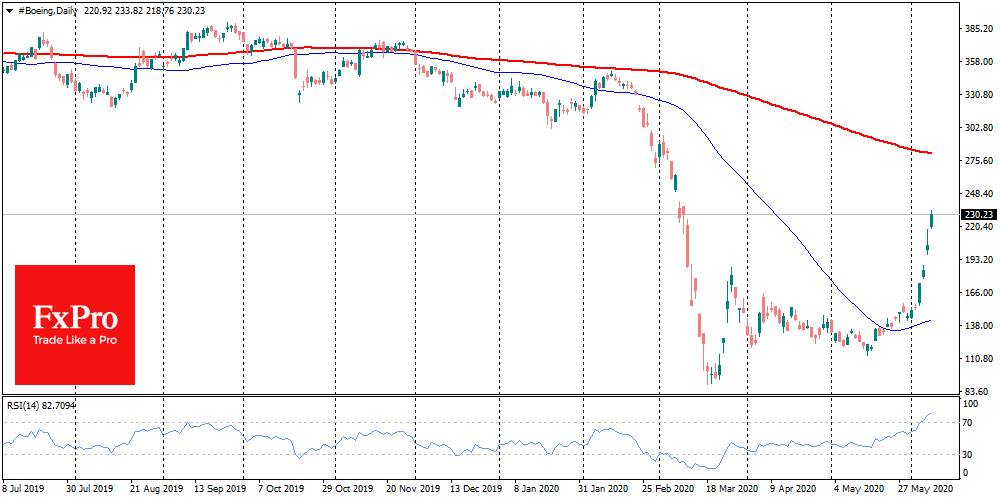

Further steps to ease restrictions between countries supported aircraft manufacturers’ stocks, allowing Boeing to take off by 25% and Airbus shares spiked by 13.7% above Thursday close. Rolls-Royce, an aircraft engine maker, climbed by 23.3% during the same period.

The banking sector in June has a positive sentiment compared to the market as a whole, as the worst fears on the labour market did not realize, which reduced the risks of a wave of delays and defaults on loans.

This situation can be described as a rotation in favour of the sectors most affected by the pandemic. However, this rally could be detrimental.

The recovery of the stock market sends a signal to politicians that their efforts have been successful and reassuring that the worst is over. If this is the case, it creates risks that the Fed may speak more harshly about future easings, while the markets already priced rock-bottomed rates for a long time.

What’s worse, the market euphoria risks switching US politicians into “election mode”. They have previously demonstrated cohesion in approving stimulus packages. However, now they can start to pursue their interests: Democrats are in favour of support of the people, while Republicans prefer to help businesses. Their arguments and the ability to veto support packages can seriously stretch the time it takes to adopt a new stimulus.

This support is necessary because, despite recent job rise, the US missed 19.3 million jobs compared to February. And this reality is frightening because a decline in income will follow a spike in one-time payments.

Even if you look at the stock market as an indicator of expectations rather than a reflection of reality, there is also reason to think about the income. Companies in the S&P500 are expected to have earnings per share within $125 compared to $175 in January. In 2021, the average estimates of market participants suggest that earnings will recover to $162, which is still lower than the market peak. This means that the markets have quickened too much in the recovery rally, which makes it vulnerable to impressive corrections in the coming days and weeks.

The FxPro Analyst Team