The financial markets are trying to determine the future direction after a wave of decline on Monday. The dollar, which yesterday added against most competitors, has little change at the start of trading this morning.

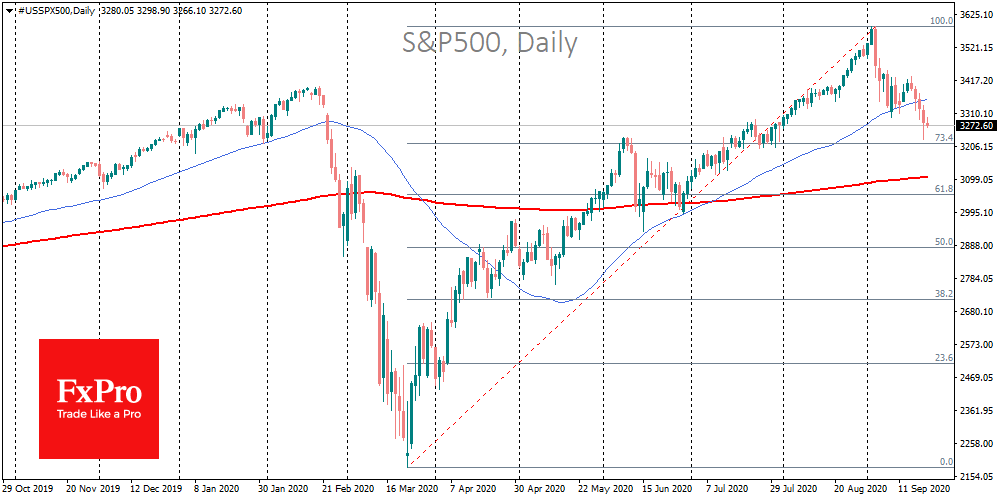

The development of the growth momentum of the US currency from current levels risks triggering an even deeper correction for the financial markets. Technical analysis suggests that we may soon face increased pressure in the US stock market as major indices fell below the 50-day moving average, which was an important support level since June.

Yesterday, at the close of the day, the S&P 500 managed to hammer back some of the losses, which should be seen as a sign of optimism by professional market participants, who are most active at the close of trading. The index found some support after a 23.6% correction from the March-September rally. In the case of increased bear pressure, the next significant support for S&P500 is seen in the area of 3100, where the 200-day moving average resides.

The dynamics of the currency market may be an important indicator for stock indices.

In the risk assets sell-off wave, the dollar index and EURUSD crossed their 50-day moving averages, threatening to break the trend of recent months (which was a decline for the former and growth for the latter). If the dollar bulls manage to get the upper hand from current levels today, we should be prepared for a new storm in the markets and a sharper recovery of USD.

However, the recent history is still not on the bulls’ side. Over the last two months, buyers of risk assets have been increasing dollar sales close to current levels. Market dynamics at the close of the session indicates that professional traders are eager to buy back the drawdown by purchasing shares of well-known and strong companies.

The big question remains as to whether the optimists will have the strength to turn the markets up again. We will soon find out!

The FxPro Analyst Team