Dollar

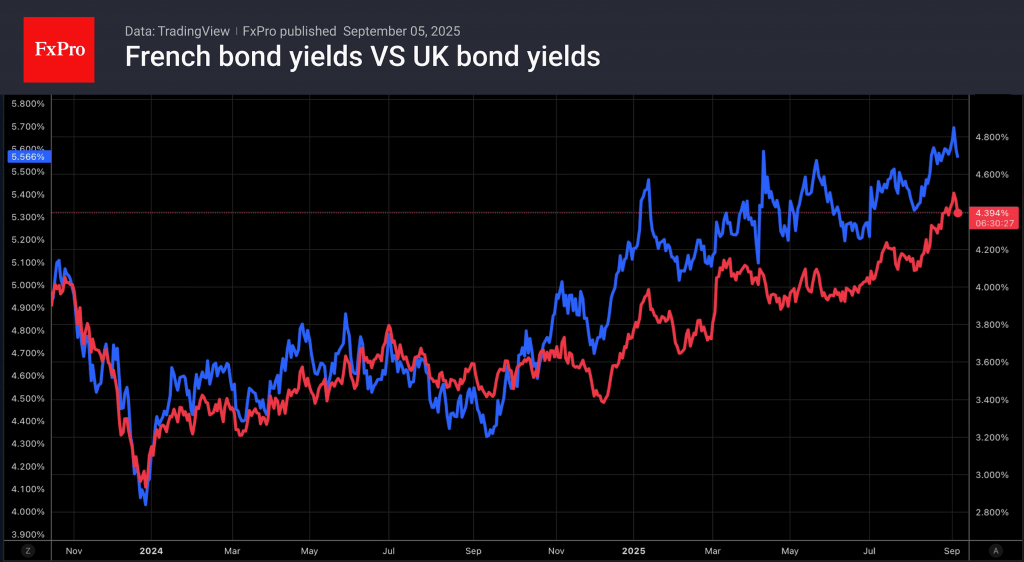

For a while, the US dollar became the cleanest shirt in a laundry basket. Treasuries were not being sold off as quickly as European bonds. Yields on British gilts soared to their highest levels since 1998, for French debt it was the highest since 2008, and for German bunds since 2011, against the backdrop of concerns about fiscal discipline. Investors are concerned that Rachel Reeves will not be able to close the 35 billion pound budget gap, that François Bayrou’s government will resign, and that Friedrich Merz has gone too far with fiscal stimulus.

Against the backdrop of political unrest in France and fears over the global debt crisis, the US dollar was bought as a safe-haven asset. Rumours of Hiroshi Moriyama’s resignation as leader of Japan’s ruling Liberal Democratic Party did not allow the yen to resist the dollar.

Disappointing US labour market statistics helped bring the greenback bulls back down to earth. Job vacancies fell to their lowest level in 10 months, hiring slowed, and the unemployed needed more time to find new jobs. As a result, the futures market raised the chances of the Fed’s monetary expansion in September to almost 100%. The USD index retreated from the upper limit of the consolidation range from 97.6 to 98.6.

Stocks

The US stock market began a difficult period with a decline but quickly recovered. September is the worst month for the S&P 500. According to research by Bank of America, since 1927, the broad stock index has fallen in 56% of cases, by an average of 1.17%. The first year of a presidential term has been even worse, with 58% cases of decline, averaging 1.62%. UBS claims that over the past decade, the market has fallen by an average of 2% in September.

The S&P 500’s fundamental valuations do indeed appear to be overestimated. They exceed 22 times expected annual earnings, which has not happened in 35 years, except for the dot-com bubble and the pandemic. Market concentration is now at its highest, with the share of six technology giants in the broad stock index exceeding 30%. In such conditions, news from large issuers can shake the entire market.

Unsurprisingly, news that Alphabet had avoided a strict antitrust ruling to sell Chrome and that Apple intended to launch AI-based web search tools for Siri, allowed the S&P 500 to quickly recover its lost ground.

The FxPro Analyst Team