Markets are optimistic for economic recovery in the U.S. and around the world. This week’s macro data has often exceeded expectations, reflecting a faster than expected recovery. Besides, the number of daily fatalities from COVID-19 in the world and the U.S. remains relatively stable, with positive news on the development of vaccines.

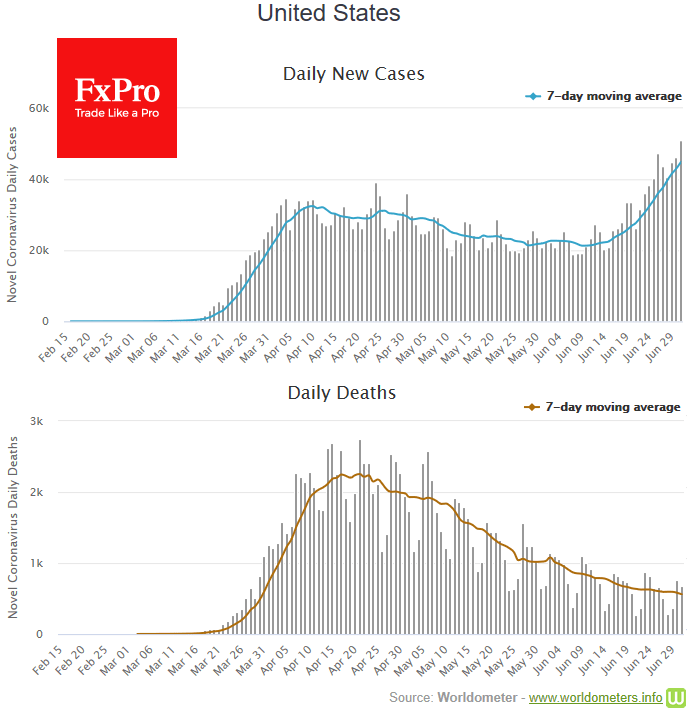

The positive news background allows markets to shrug off reports of record daily infections in the U.S., Brazil, India, and several other countries. In part, we are witnessing higher infection rates due to the broader use of testing, which means the picture is closer to reality now than it was in March-April. However, we cannot merely ignore the spike in cases. Companies in the U.S. one after another are pausing their plans to open retail outlets and are even considering closing them again. The latest examples are McDonald’s and Apple, which have closed retail outlets in several states because of the sharpest spike in infections.

Despite that, the markets keep positive dynamics, considering that the worst moment in the economy is already behind us. The spike in infections has not yet resulted in the nation-wide lockdowns on a national scale, allowing companies to bring people back to work.

ADP data released on Wednesday showed U.S. private-sector employment growth of 2.37m in June. Official employment data (NFP) which will be released today, is expected to show an increase in employment by 3m on average after growth of 2.5m a month earlier.

However, it is essential not to lose sight of the bigger picture. The U.S. labor market lost over 21.5m jobs during March-April. Judging by these rates of decline, it won’t be able to return to February levels by the end of the year. Long-term losses of the labor market are also evidenced by extremely high weekly jobless claims, exceeding 1.4m per week.

Companies continue to cut back employees based on long-term economic forecasts. The most affected industries (tourism and recreation) are already cautiously hiring, but industries tied to the economy (manufacturing, retail, etc.) continue to “optimize” their staff.

This situation limits the potential for recovery in demand for risk assets in general. For the currency market, this promises to result in further frequent switching between risk appetite and flight to protective assets, which may turn into a sideways trend for the dollar against major currencies.

However, the circumstance may turn out to be more harmful to the American currency. High rates of new infections will prevent the full recovery of business and consumer activity in the U.S., in contrast to Europe and China, where the situation has improved dramatically in recent months. As a result, the Fed may continue to put pressure on the monetary easing pedal, while the government may increase its incentives against more cautious steps in Europe and China. In this case, the dollar may start a multi-year cycle of smooth easing with potential targets at 1.18 at the end of the year.

The FxPro Analyst Team