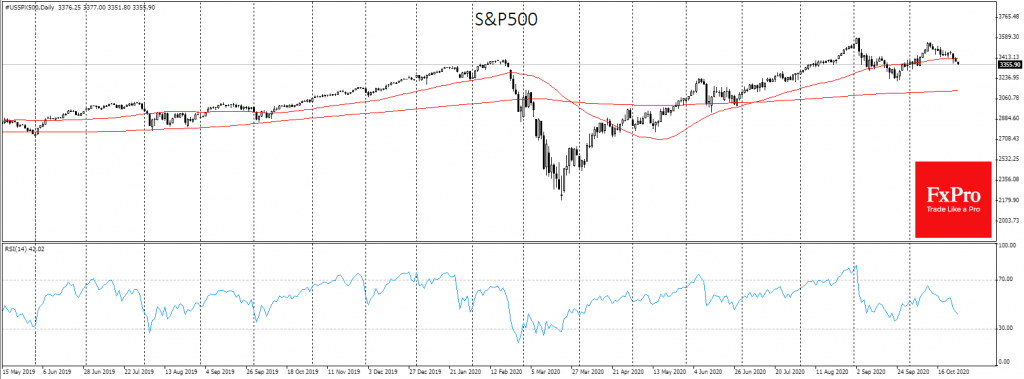

The situation in the markets appears increasingly cautious. Key US indices are developing a decline and Futures for S&P500 are losing 0.5% today after the main index fell by 0.3% on Tuesday. The latest round of pressure brought the index back to a three-week low and below the 50-day average, which is a short-term bearish signal.

In June and early September, equities found support in the dips towards this line, reflecting buyers’ interest and bargain hunting. Now we see a weakening of the bull’s impulse.

In the run-up to the US presidential election, investors may be doubly cautious, which could deepen the correction. Under these circumstances, the S&P 500 could withdraw reasonably quickly to test more important support in the form of a 200-day average, which is 7% below the current levels. This movement is quite possible due to election nervousness and especially in the first hours after the results are announced.

Additionally, market anxiety is heightened by the appreciation of the yen against the dollar. Exactly one week ago we noticed a sharp drop in the USDJPY, which often signals an increase in seller’s traction. The pair then managed to stay above 104, a psychologically important round level and rose again to 104.10 for the dollar, below which it has only spent a couple of days in March during the previous four years.

A week earlier, the yen had been growing without stock indices, but now the USDJPY and S&P500 began falling in unison.

They are echoed by the European market, where the DAX30 lost 10% from its October peaks, and 6% lost so far this week. The RSI index on the daily charts of the DAX30 fell into an oversold zone, where it was last seen in March. The pressure on it is somewhat related to coronavirus restrictions that are being introduced and discussed in Germany.

All of this is of particular concern. Without an upward reversal of USDJPY and the German and US stock indices soon, it is better to be prepared for a sharp increase in volatility on a wide range of financial assets, including raw materials and currencies from developing countries.

The important point is that the current wave of anxiety is not just about election uncertainty. Records of illness may be followed two or three weeks later by death records, which the authorities can only halt by enduring economic losses that can quickly affect markets.

The FxPro Analyst Team