US dollar

The escalation of trade conflicts has led to a temporary strengthening of the US dollar. Donald Trump has sent numerous letters to various countries specifying the size of tariffs. They will come into effect on August 1st. Until then, the White House is open to negotiations. There are rumours in the market that the United States will soon conclude trade deals with India, Taiwan, and the European Union.

According to Deutsche Bank, the average US tariff is 18.7%. This is lower than the 22% that was in place on Independence Day. However, the figure is still high. Such import duties increase the risks of an economic slowdown and accelerating inflation, but there is no talk of a recession. Therefore, the USD index did not fall as it did in April.

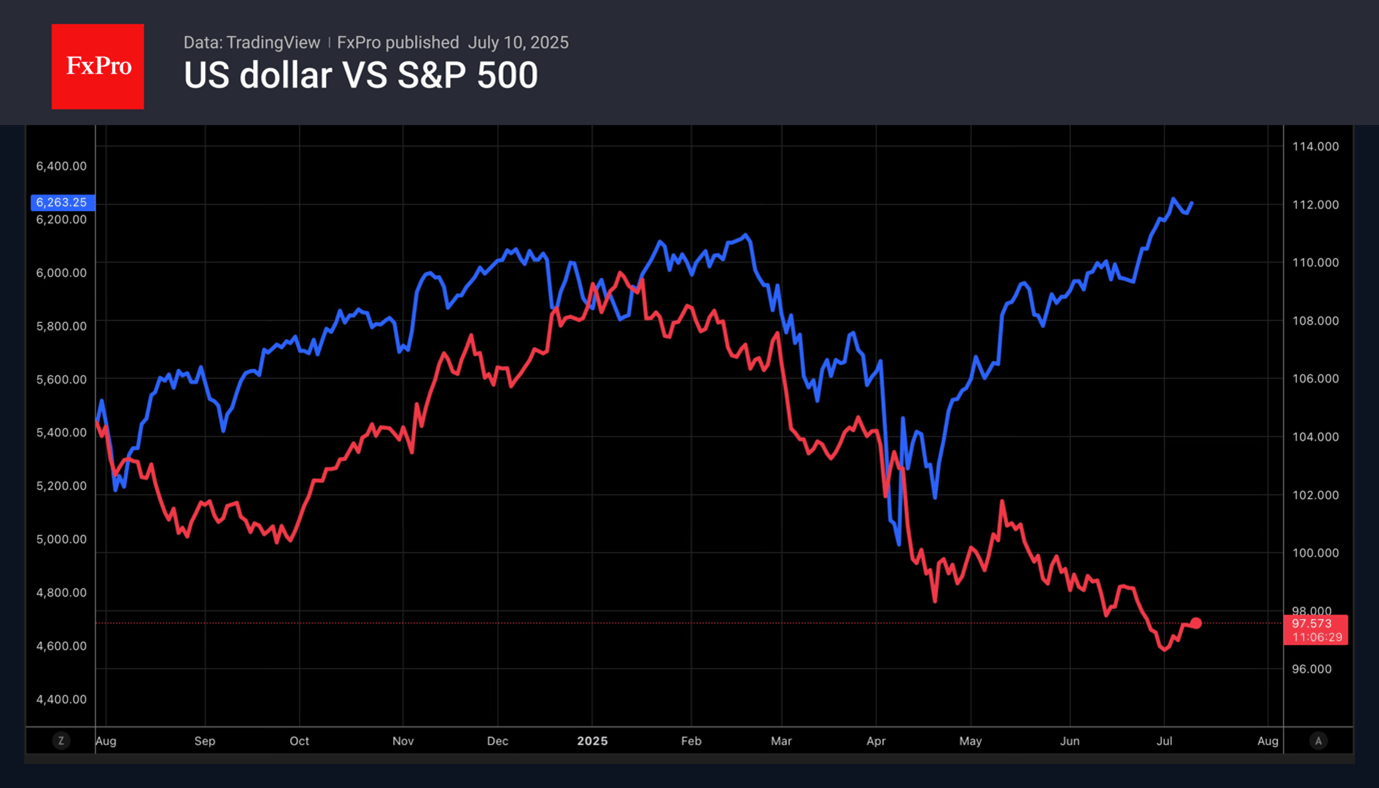

Investors have moved away from the ‘sell America’ strategy. As a result, the dollar and US stock indices have diverged. The greenback is once again behaving as a safe-haven asset, falling when risk appetite rises and vice versa.

Stock indices

After a slight dip due to Donald Trump’s letters, the S&P 500 began to rise again. The stock market perceived the escalation of the trade conflict as prolonging the delay. Investors bought up the dip. The US economy is strong, inflation is slowing, and corporate profits are high. In such conditions, the potential for a correction in the broad stock index is limited. Bank of America raised its forecasts for the index of the 500 largest companies to 6,300 and 6,600 at the end of the year and in 12 months. Goldman Sachs sees the market at 6,600 and 6,900.

Technology corporations are leading the stock market rally. NVIDIA became the first company in the world whose capitalisation exceeded $4 trillion. Since the beginning of the year, its shares have risen by 20%, and since 2023 by more than 1000%. This allowed the Nasdaq Composite to update its record highs. The S&P 500 came within arm’s reach of them.

Stock indices are supported by expectations of a resumption of the Fed’s monetary policy easing cycle and a successful auction of $39 billion in 10-year Treasury bonds. High demand led to a decline in yields, and the S&P 500 is seeing new record highs.

The FxPro Analyst Team