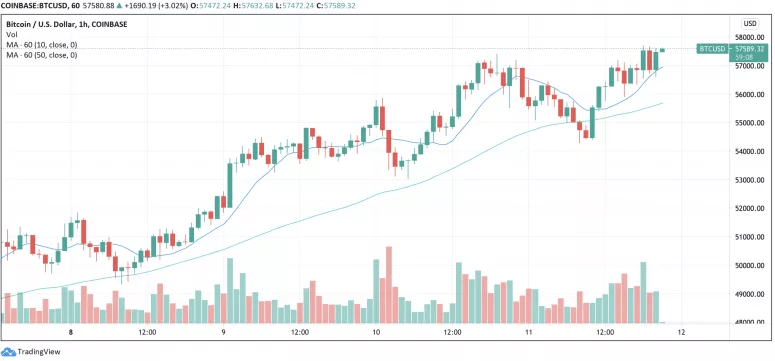

The bitcoin market is back in bull mode but for one key attribute, almost like a missing tooth: low trading volume. Bitcoin’s price on Thursday extended its winning streak to a seventh day as a renewed appetite for risk-taking in traditional markets sent U.S. stocks to new record highs. The catalyst was a U.S. government report on Wednesday showing a slower-than-expected inflation rate in February, which assuaged investors’ concerns that fast-rising consumer demand might send prices shooting higher as the economy reheats.

Ether (ETH), the second-largest cryptocurrency by market capitalization, was up on Thursday, trading around $1,812.13 and climbing 0.26% in 24 hours as of 21:00 UTC (4:00 p.m. ET). The correlation between bitcoin and ether is trending downward again after rising for about two weeks starting Feb. 21. Compared with the same time period a year ago, the correlation between the No. 1 and No. 2 cryptocurrencies by market capitalization is slightly weaker, dropping to about 0.74 from 0.94.

Market Wrap: Bitcoin Rallies Near $58K, Stocks Soar to Record Highs, CoinDesk, Mar 12