Nvidia and OpenAI have become synonymous with the AI revolution, each offering its own breakthrough solutions. This has made Nvidia the most valuable company on the market. OpenAI remains private for now. However, the old guard of IT giants, such as Microsoft and Alphabet, are not standing on the sidelines of the AI race, although they are conducting it in different ways, which is affecting their shares differently.

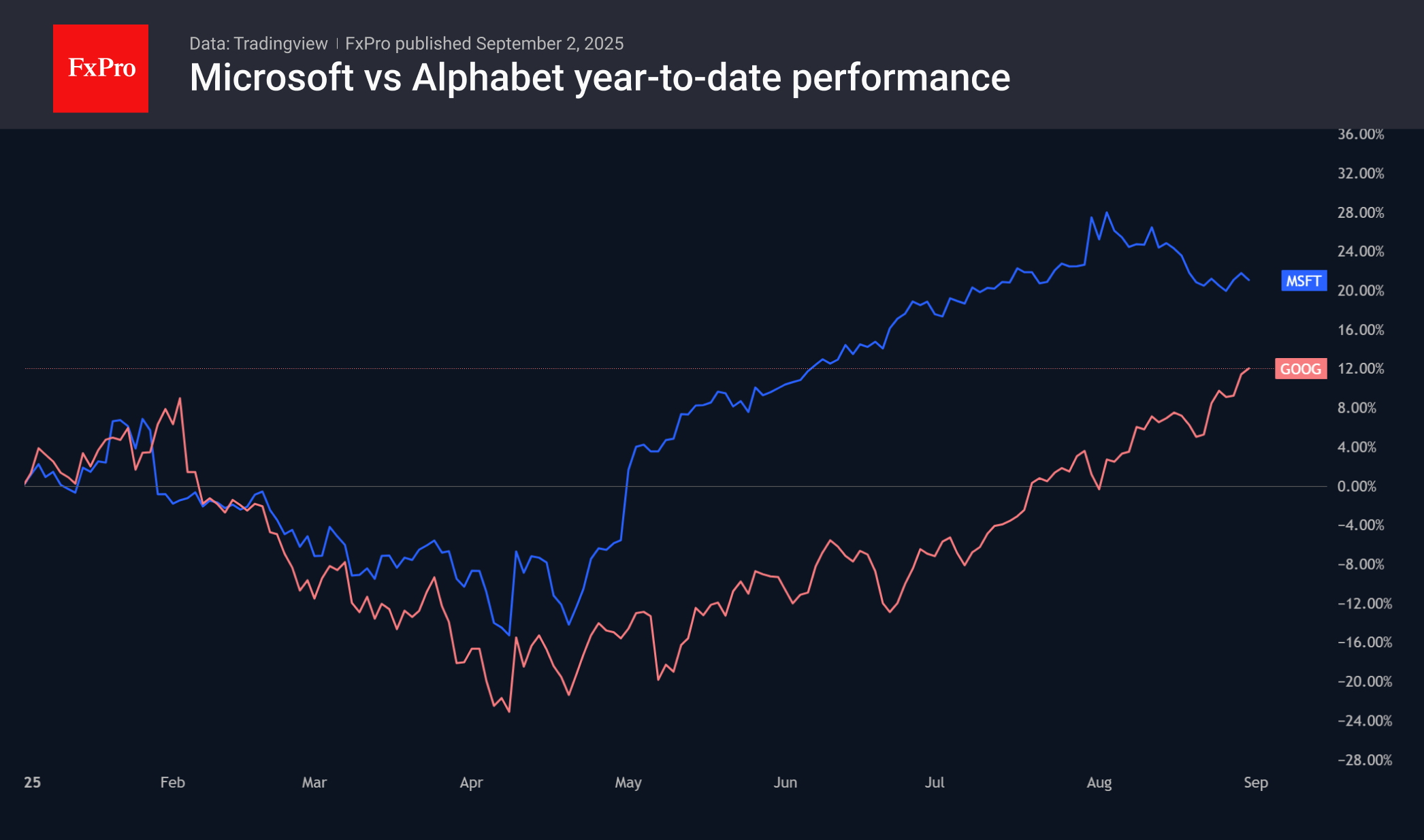

Microsoft owns a stake in OpenAI, giving it access to the latest developments, but integrates them into its own programmes, including chatbots. For a long time, betting on Microsoft was an indirect bet on OpenAI with their well-known ChatGPT. This approach paid off earlier this year, as the share price recovered faster than many competitors after the April slump. From its lows at the start of April to its highs at the end of July, the stock soared 55%, already making its way to historic highs since the beginning of June.

For a long time, Alphabet shares lagged their competitor in terms of share price growth over the past five years. They were also weaker in their recovery after the April correction, adding 40% to their lows before peaking at the end of July.

However, since August, the markets have clearly shifted into a different mode, with MSFT falling 7.5% against GOOG’s 13% growth. This divergence began even before the release of GPT-5, the latest model, which faced widespread criticism from users, forcing the company to revert to GPT-4, originally announced over two years ago. Negative sentiment was also fuelled by comments from OpenAI CEO Sam Altman, who acknowledged that the market is currently in a bubble due to inflated expectations.

Google Gemini is steadily developing and gradually gaining consumer support due to its convenient integration into the company’s extensive ecosystem. This aspiration resonates with investors. It seems that market participants are seeking to diversify their bets on AI agents, creating demand for Alphabet shares at the expense of Microsoft.

September marks the end of the financial year in the US, and investors often use August and September to switch to new trends or restart existing ones. September is historically the worst month for stock indices, but it can also be a good entry point during a downturn.

It is only important to understand whether we are seeing the start of a trend reversal or a temporary correction. Signals of this should be sought in MSFT’s dynamics. Technically, with the stock trading at $506, it remains within a corrective pattern as long as it stays above the $450–$470 range. The upper bound aligns with last year’s peak and the 61.8% Fibonacci retracement of the rally from the April lows to the July highs, while the lower boundary corresponds to the 200-day moving average. A break below this level would signal a deeper trend reversal.

GOOG shares are close to local overbought conditions, as the RSI on daily timeframes is approaching 75, near which the shares have experienced local corrections over the past six years. Therefore, there is a high chance that both shares will soon experience increased selling pressure; the only question is how deep this correction will be.

The FxPro Analyst Team