US indices rose impressively on Tuesday, with the S&P500 up 1.1%, the Nasdaq100 up 1.75% and the Dow Jones 30 up 0.63%. Meanwhile, the VIX volatility index fell back below 14, and Bitcoin gained over 1.4%, at one point wiping out the losses of the previous three sessions. This pattern of market gains points to an improvement in risk appetite, but the rise raises questions.

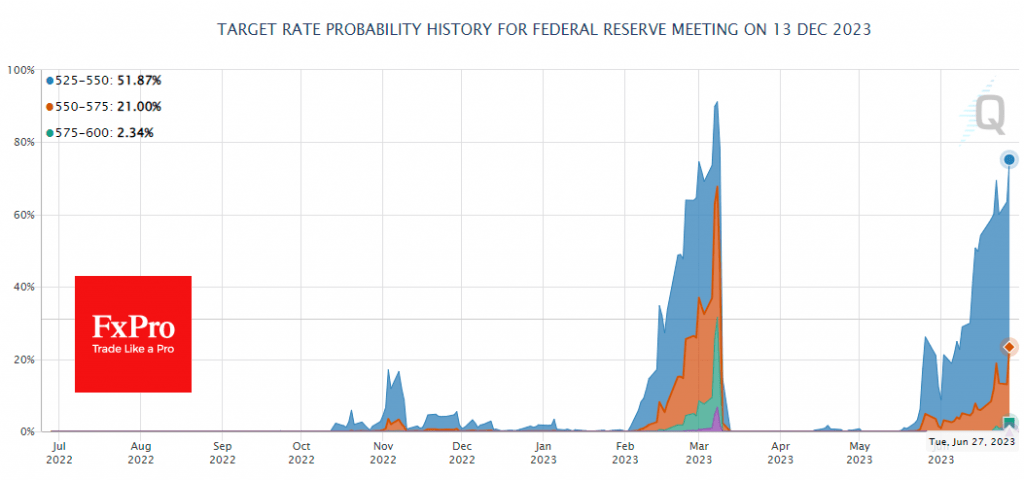

Tuesday’s positive market performance and much of the rally in equities run counter to interest rate expectations. The FedWatch tool now shows a 75% probability that the Fed funds rate will be higher than the current rate at the end of the year, although, since mid-March, the chances of this happening in the next two months have been estimated at zero. Higher interest rates are a severe headwind for the equity market as they make risk-free investments more profitable.

As a result, there has been a startling divergence between the expectations of smart money (debt markets) and the sentiment of equity market participants. The equity market is an optimists’ place, and a justification for buying in recent months has been a mix of factors, from the AI hype to the exhalation that there have been no new bank failures and the “most anticipated recession” has not arrived.

At the same time, positive surprises are working in favour of a tightening of the Fed’s rhetoric, which is setting up the possibility of two more hikes before the end of the year, even though the previous hikes are far from having had their full effect on the economy. The situation is reminiscent of what it was after the “monetary and fiscal frenzy” of the coronavirus days. After all, the initial consensus was that the trillions pumped in would not cause inflation or would do so, but only temporarily. It was not until 2022 that it became clear that inflation would require the most vigorous fight against it in 40 years.

If we are correct, then the inertia of monetary policy will have a significant negative impact on equity markets, which are struggling to cope with the level of interest rates, the abundant supply at US Treasury auctions and the increasingly complex conditions for debt refinancing. Frankly, Fed rate hikes are attempts to cool the economy, i.e., reduce demand, which harms corporate earnings.

The technical picture also points to a decline, at least in the short term. The Nasdaq 100 has made a local peak just above 15,200, which also reversed in March last year and August 2021. On the daily timeframe, the RSI has retreated from the overbought territory that, signals the start of a correction. And it is close to a similar signal in the weekly timeframe. A full correction here could take the Nasdaq100 towards 12100-12500 before the end of the year, leaving the long-term uptrend intact and staying above the 200-week moving average but erasing the excessive optimism.

The FxPro Analyst Team