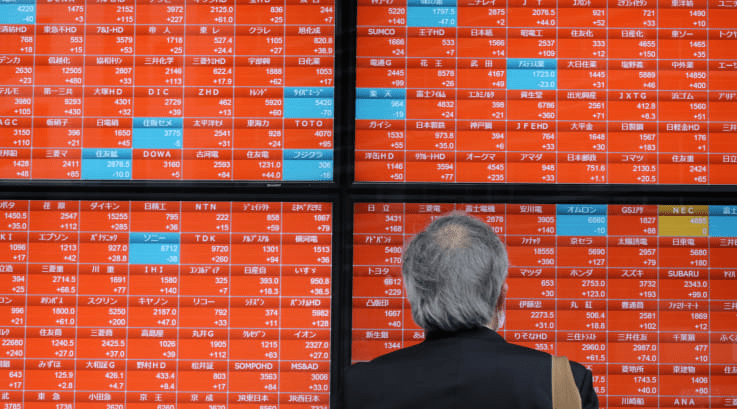

Major markets in Asia Pacific have bounced back strongly following a historic period of volatility and uncertainty in March, as the world grappled with a rapidly spreading coronavirus pandemic that left many economies on pause as lockdown measures were put in place.

In fact, some regional indexes — such as South Korea’s Kospi — surged as much as 49.45% as of Thursday’s market close, according to calculations done by CNBC with data from Refinitiv.

Here’s a look at how other major stock indexes regionally have performed since touching their 52-week low in March, as of their Thursday closing figures:

Australia’s S&P/ASX 200: +36.1%

China’s Shanghai composite: +10.29%

Hong Kong’s Hang Seng index: +15.27%

India’s Nifty 50: +33.52%

Japan’s Nikkei 225: +38.74%

Singapore’s Straits Times Index: +22.59%

Taiwan’s Taiex: +33.67%

Thailand’s SET Composite Index: +45.6%

Stocks elsewhere in the world also saw major gains, with the S&P 500 stateside up 42% from its 52-week lows in March, while the pan-European Stoxx 600 surged 36.37%, based on calculations by CNBC with data from Refinitiv Eikon as of Thursday’s closing numbers.

Global markets made a strong comeback from their plunge a few months ago, as central banks and governments around the world pumped money into the economy through massive stimulus packages.

On Thursday, the European Central Bank announced plans to boost its Pandemic Emergency Purchase Programme by 600 billion euros.

Earlier this week, South Korea unveiled a 35.3 trillion won ($29 billion) supplementary budget, raising the total stimulus to 270 trillion won as it continues to battle the economic hit from the coronavirus, according to Reuters.

The U.S. Federal Reserve has also made unprecedented moves in an effort to prevent the American economy from collapsing.

Major markets in Asia Pacific jump as much as 49% from their March lows, CNBC, Jun 5