Will central bank meetings and the release of US employment data restore investor interest in the economy? Or will the fate of the dollar be decided by a new shutdown? Politics drove the USD index’s rollercoaster ride. First, there were Donald Trump’s tariff threats against Europe, followed by the Republicans’ retreat. Then, Forex moved even more actively when the president announced his support for weakening the greenback.

The development of a bearish trend in the Dollar could be a catalyst for slowing inflation in other regions. Investors will be interested to see the ECB’s reaction after EURUSD reaches 1.20. In 2025, Vice-President Luis de Guindos noted that this is not good for the eurozone economy.

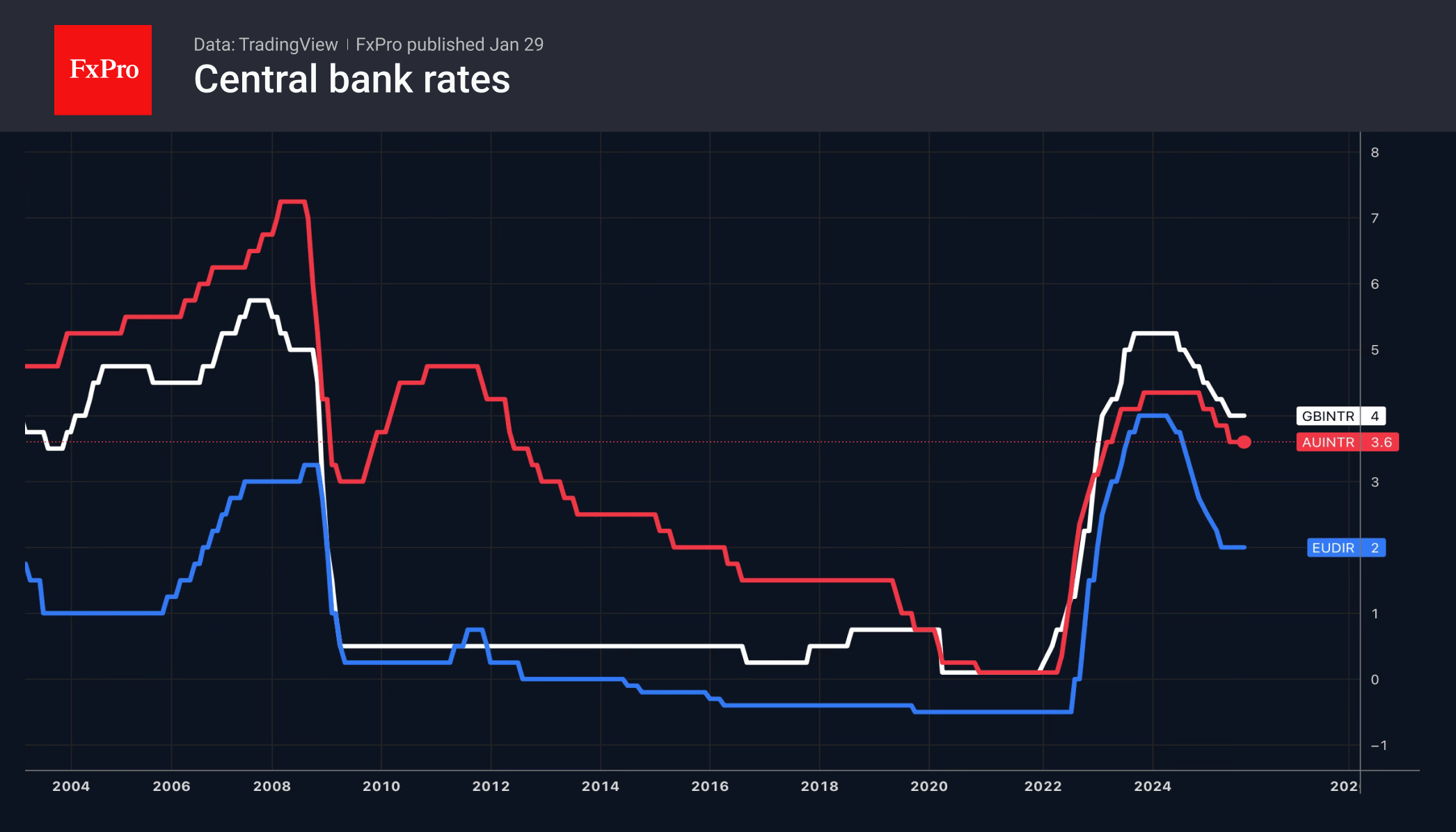

Unlike the European Central Bank and the Bank of England, the Reserve Bank of Australia may raise its key rate. The futures market has raised the chances of such an outcome to 60% amid accelerating inflation and falling unemployment.

US labour market statistics for January will confirm or refute the idea of its stabilisation, which will affect the future of federal funds rates and the US dollar.

The FxPro Analyst Team