Data on the US and Chinese trade balances will show how effective Donald Trump’s restructuring of the international trade system has been. Final figures on European business activity and statistics from American purchasing managers will demonstrate the resilience of economies to tariffs.

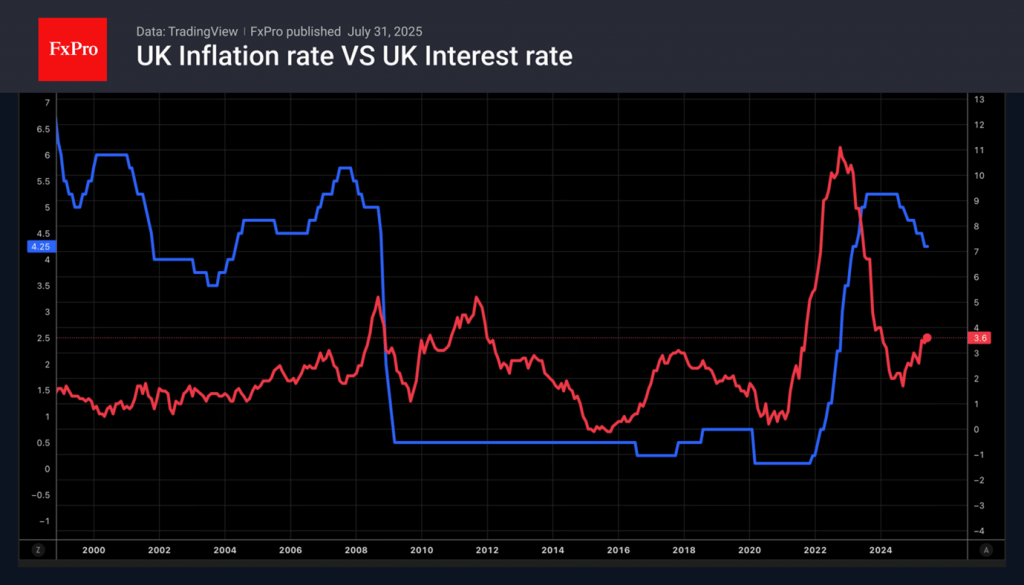

Particular attention will be paid to the Bank of England meeting. Will it want to lower the repo rate or extend the pause in the monetary expansion cycle? The British economy is not yet falling off a cliff, and inflation is high. Perhaps Andrew Bailey and his colleagues will not rush into anything.

The economic calendar for the first full week of August is hardly busy. Numerous trade deals point to a de-escalation of the conflict. However, Mexico’s, Canada’s, and Brazil’s stubbornness may anger Donald Trump and dampen global risk appetite.

Markets will closely monitor developments regarding the possible imposition of US sanctions against Russia and secondary tariffs against countries that buy oil from it. This could seriously affect the commodity market situation.

The FxPro Analyst Team