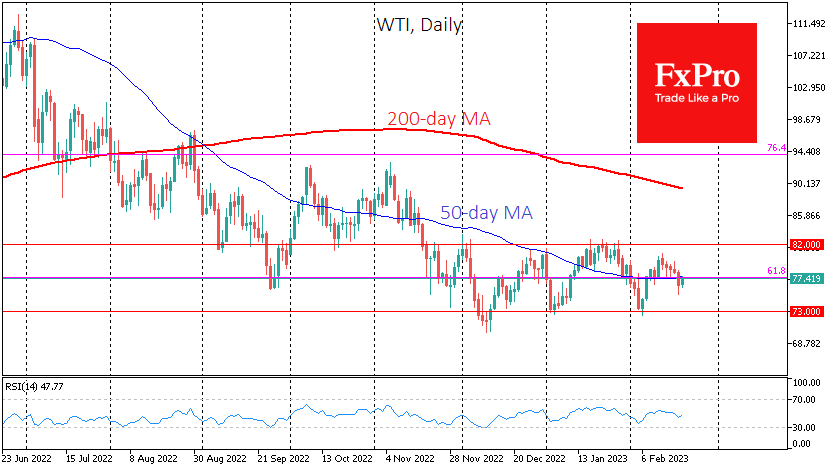

For the third month, oil has barely moved out of its wide range of $73-82 for WTI barrel and $78-88 for Brent. This is not a balance and equilibrium of supply and demand forces but a tug of war.

This does not often happen in large liquid markets, but the range movement has more to do with political actions and statements than the market’s technical picture. The recent reversal from the upper end of the range coincided with the US postponing the start of the renewal of the strategic reserve. A move closer to the lower boundary in early February coincided with comments from Russian officials that production would be cut by 500K barrels per day.

The sideways movement forms a stable reflex for traders, but it is important to understand that this trading mode only lasts for a while. This is a case when macroeconomics can determine the exit direction from the range. And the current data snapshot suggests an exit from this sideways range.

The strong US labour market has not led to a significant increase in oil demand, and commercial inventories have risen from 420M to 471M in recent weeks. This is 14.6% higher than in the same week a year ago. Inventory levels above 500m have coincided with periods of extreme market tightness (March 2016, February 2017 and April 2020) associated with price falls before or after. More recently, the idea that the US government is acting as a strong potential buyer has temporarily supported prices.

It is worth being prepared that the fight against inflation is still ongoing, so it would be wise to expect oil purchases for reserves to start any time soon, as this would send a counterproductive signal. Regardless, it is worth remembering that the recent robust labour market data and inflation surprises increase the chances that the Fed will go further in its rate hikes than previously hoped. The latter is bad news for oil, which is very sensitive to the dollar and interest rate movements.

A hypothetical bearish scenario looks viable if prices fall below $72 in the coming weeks. A consolidation would open the way to $62, where oil bottomed out several times since April 2021.

Conversely, a move above $83 would signal that a correction from the global lows of April 2020 to the highs of June 2022 has occurred and that a new mega-wave of growth awaits oil. This scenario is hard to believe, given that prices have dragged global economic growth over the past year.

The FxPro Analyst Team