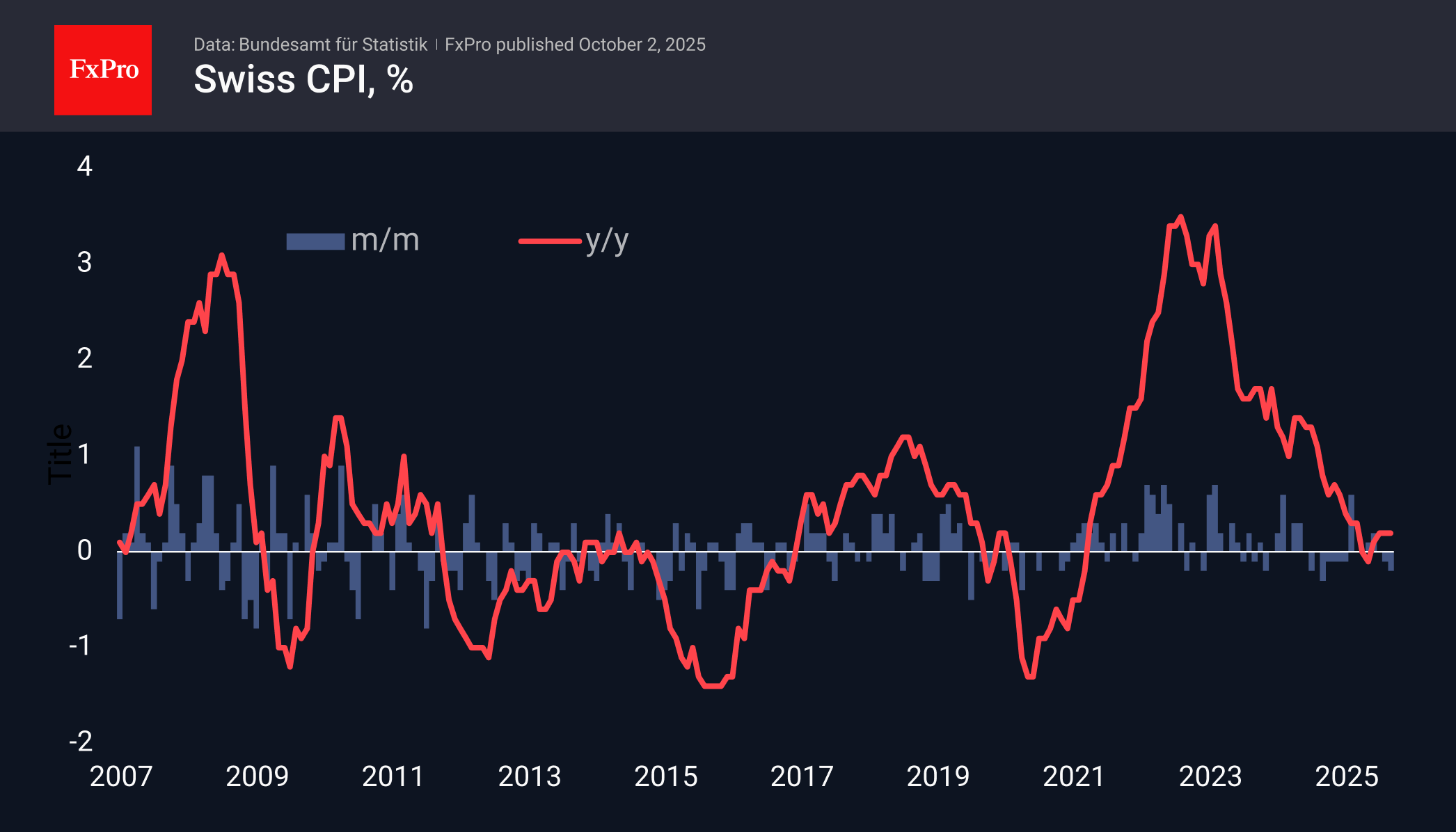

Consumer prices in Switzerland fell by 0.2% in September. Annual price growth was 0.2%, remaining at this level for the last three months and slightly below the average forecast of 0.3%.

The decline was due to the strengthening of the franc, which lowered prices for air and transport services. These data are further evidence that the Swiss National Bank had room to cut rates. However, at its last meeting, it preferred to keep them at zero, opting for more situational measures – currency interventions.

Earlier, it was reported that at the end of the month, the SNB conducted its most significant currency interventions in many years to weaken the franc. However, these measures were intended to maintain the exchange rate ceiling, not to scare market participants.

As a result, EURCHF has continued to trade just below 0.9350 for the last four weeks and within a 1.5% range symmetrically around this mark for the last five months. This does not look like a smooth reversal. Rather, it looks like the formation of a floor in the pair, like what happened from 2012 to 2014, but without official confirmation.

It is generally accepted that low inflation is bearish news for a currency. However, there is an important exception to this rule: it only works if the central bank is expected to ease monetary policy. This is not the case in Switzerland, which historically has lower inflation than its European neighbours and a long-standing trend of franc appreciation. Interestingly, Switzerland manages to maintain a foreign trade surplus and sustain capital inflows, which also works in favour of the currency in the long term.

The FxPro Analyst Team