The S&P 500 is forming a “double top” going into the U.S. election, which is a worrying sign for investors, according to veteran investor Mark Mobius. A double top is a bearish technical indicator, where an asset’s price hits two consecutive highs with only a moderate decline between the two peaks. If the price then falls below the support level reached during the intermittent low, a double top is confirmed.

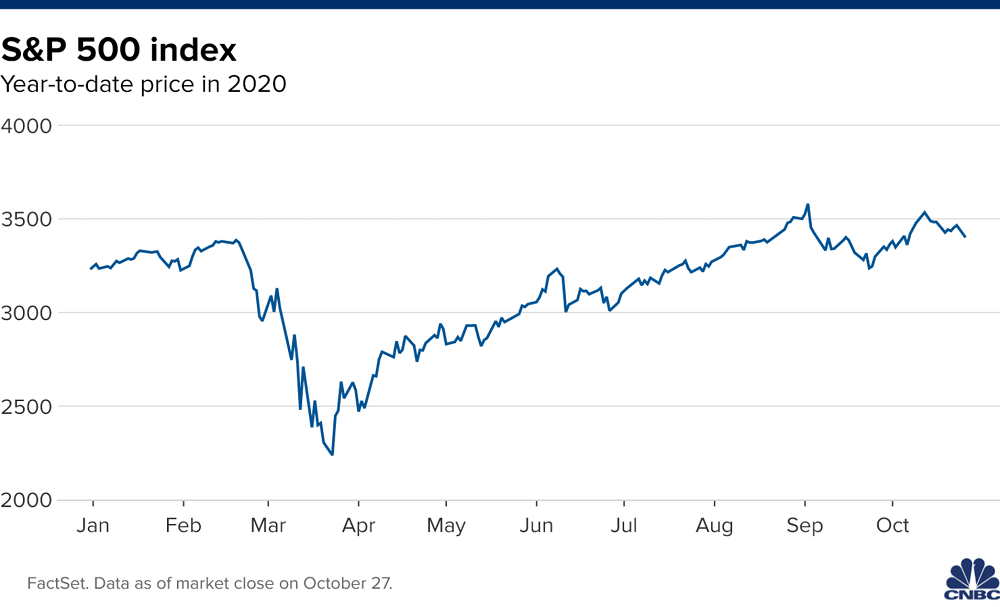

The S&P notched a record high to close above 3,580 points on September 2, capping a recovery for equity markets following the crash in March, when the coronavirus pandemic began to spread throughout the U.S. and Europe. Having then endured a sharp decline fueled by a sell-off of the tech megastocks which drove the recovery, the S&P 500 climbed back to 3,534 points in mid-October. As of Monday’s close, the index sits at just over 3,400 and is up more than 5% year-to-date.

Speaking to CNBC’s “Squawk Box Europe” on Tuesday, Mobius, founding partner of Mobius Capital Partners, said next Tuesday’s U.S. election was having a “big bearing on the markets.”

Should the result look close in the days following the election, as states count an unprecedented deluge of mail-in ballots, current President Donald Trump has indicated that he would look to contest the outcome in the event of a win for Democratic challenger Joe Biden. Analysts broadly believe that a prolonged period of political uncertainty, should the election result end up in the courts, would roil global markets.

Mobius also suggested that U.S. and global markets will suffer if Joe Biden wins, but only in the short term as investors wait to see what policy measures Biden pursues. “If he decides not to impose tax increases, then that would be good for the markets, so we have to watch what the actual actions are once he gets into office, if he does get into office.”

Looks like a ‘double top’ in the S&P 500, investor Mark Mobius warns, CNBC, Oct 27