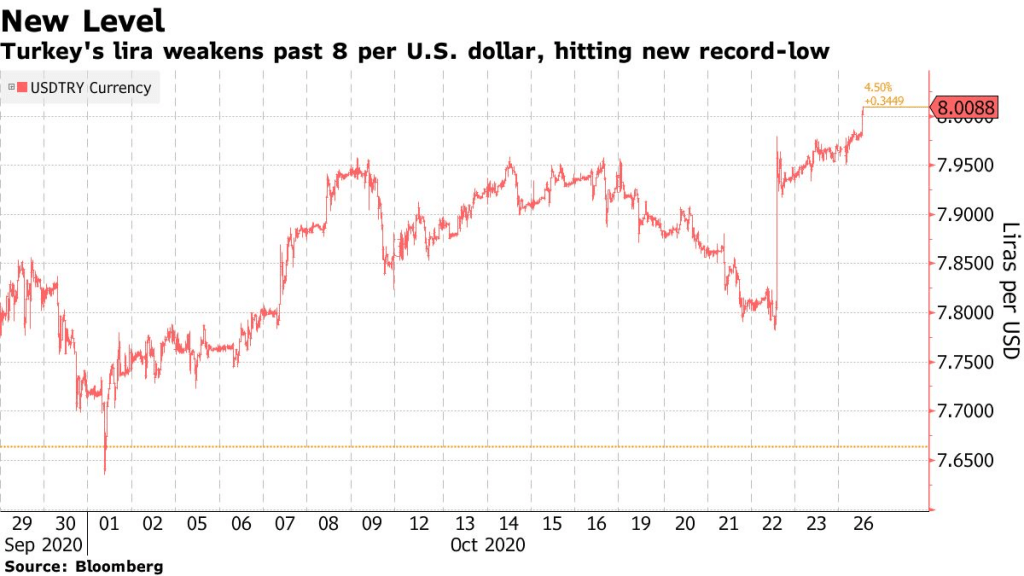

Turkey’s lira weakened through 8 per dollar for the first time amid deepening skepticism over the central bank’s efforts to shore up the currency at a time of rising geopolitical tensions. The lira fell as much as 1.3% to 8.0667 per U.S. dollar before trading 0.9% lower as of 12:22 p.m. in Istanbul. It was the biggest decline among emerging-market currencies Monday and extended a nine-week streak of depreciation, its longest rout since 1999.

Turkey’s central bank rattled investors last week by unexpectedly keeping rates on hold, a move that halted a brief recovery in the currency ahead of the decision. The regulator has already spent foreign-exchange reserves faster than any other major developing economy to try to support the lira. Foreign investors sold $13.3 billion of Turkish equities and bonds this year, the most since at least 2005.

Foreign-investor interest in Turkish assets is being additionally sapped by a string of geopolitical risks. President Recep Tayyip Erdogan’s government faces possible U.S. sanctions over the purchase of a missile system from Russia and is engaged in territorial disputes in the eastern Mediterranean and the Caucasus.

Government-owned lenders sold at least $400 million on Monday, according to two people with knowledge of the matter, who asked not to be identified because the details aren’t public. State banks don’t comment on interventions in the foreign-exchange market. Meanwhile, the central bank lent 5 billion liras ($623 million) through its traditional repo auction at 14.75%, the higher end of its rates corridor, according to a statement from the monetary authority.

On Sunday, President Erdogan challenged the U.S. to sanction the country over its purchase of Russian S-400 missile defense systems. He also stepped up criticism of Europe’s treatment of Muslims, repeating an attack on his French counterpart Emmanuel Macron by suggesting he needed psychiatric help.

The lira has lost more than 25% this year, the worst-performing currency in emerging markets after the Brazilian real. The Borsa Istanbul Banks Index was trading 1.9% lower.

Lira Weakens Past 8 per Dollar as Currency Rout Deepens, Bloomberg, Oct 26