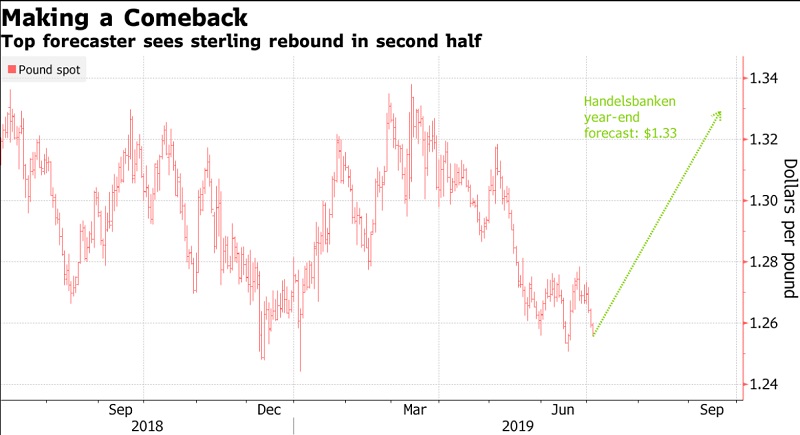

One of the pound’s most accurate forecasters is predicting the currency will rebound on expectations that Britain will miss the latest deadline for leaving the European Union. Svenska Handelsbanken AB sees sterling climb about 6% to $1.33 by the end of the year as Brexit gets delayed for a third time beyond Oct. 31 and as the dollar weakens. The bank was among the top firms in the Bloomberg accuracy rankings from in the second quarter, after successfully factoring in that Brexit would be postponed beyond its originally scheduled date of March 29. “Our main scenario is that the exit date will be postponed again,” said Kiran Sakaria, an analyst at the bank.

Their view is one of the most bullish and compares to a median forecast for the pound of $1.28 at year-end. The forecast defies the gloom from some investors who predict a fall in sterling if Boris Johnson becomes prime minister in the coming weeks, potentially raising the threat of a no-deal departure. Sakaria thinks the currency has in fact already bottomed out.

While the Bank of England has held out the prospect of rate hikes if Brexit goes smoothly, money markets are betting it will have to change tack to cut borrowing costs amid a global downturn. BOE Governor Mark Carney said this week trade tensions have increased the risks to domestic growth.