Brent crude oil has added more than 8.5% over the past week. We have seen an impressive increase in buying on a temporary decline below the 50-week moving average.

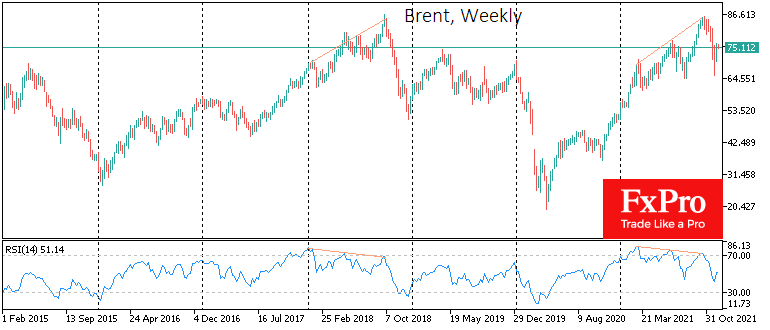

From the tech analysis side, Crude oil has so far managed to stay within the bullish trend that has been in place since last November. The oversold conditions after six weeks of decline have provided a positive backdrop for the rebound, but it risks losing strength in the coming days.

Technical analysis on the weekly charts shows a divergence between the relative strength index and price: new price highs with increasingly lower indicator peaks. This is reminiscent of the dynamics of 2018, with a corrective pullback of 35% from the peak. Such a pullback now opens the door to a decline into the $55-60 area. This scenario is realistic if the Fed’s actions and comments prove to be sufficiently aggressive on inflation and trigger a large-scale risk-off in the markets.

The fundamental backdrop makes it doubtful that oil has much room to rise. The media is explaining the latest price rises are due to oil traders not expecting any severe pressure on demand due to the new omicron variant.

Sales from the Strategic Petroleum Reserve will begin later this week in the US. At the same time, the supply of this crude is also rising for natural reasons: OPEC+ increased supply quotas in January (+0.4 million) without deviating from its roadmap over the last six months. In the USA, production is also rising, at 11.7 million BPD, a new high since May 2020.

That said, data released on Friday from Baker Hughes points to a further recovery in production as the number of active rigs rose by an additional 7 to 576, the highest since April 2020.

Simply put, the oil supply is rising, while Omicron and weaker economic recovery momentum hold back the pace of demand recovery.

We are now seeing a delicate balance in oil, which could be disrupted by many diverse factors from news about contagion dynamics and lockdowns, to Fed reaction and oil producers’ plans.

The FxPro Analyst Team