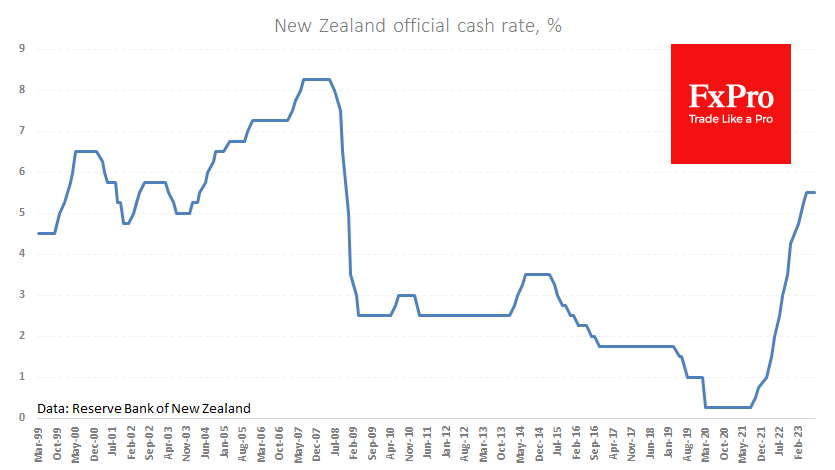

The Reserve Bank of New Zealand left its key rate unchanged for the second time at 5.5%. Most analysts predicted this decision, but it created positive momentum in the NZDUSD, which at one point added about 1% to the day’s lows set before publication.

The RBNZ’s mood has clearly shifted from raising the rate to keeping it at the current restrictive level for an extended period of time. The Central Bank notes a decline in activity in the sectors most sensitive to interest rates. In addition, they emphasise the reduction of labour shortage due to migrants and softening demand.

The positive reaction of the currency market to the Central Bank’s comments has a chance to be the starting point for a corrective recovery or even the beginning of the growth of NZD, which by mid-August was at historic lows against CHF and multi-year lows against EUR & GBP.

NZDUSD lost about 7.4% in about a month, and the intraday dip was at its lowest since last November at 0.5930. On the daily timeframes, the RSI flirted with oversold territory the day before, which hasn’t been seen since October 2022. A rise out of this area is a bullish signal, which was also well worked out by NZDUSD, adding over 15% in the last two months.

The FxPro Analyst Team