Next week, more countries will release their estimates for October consumer inflation.

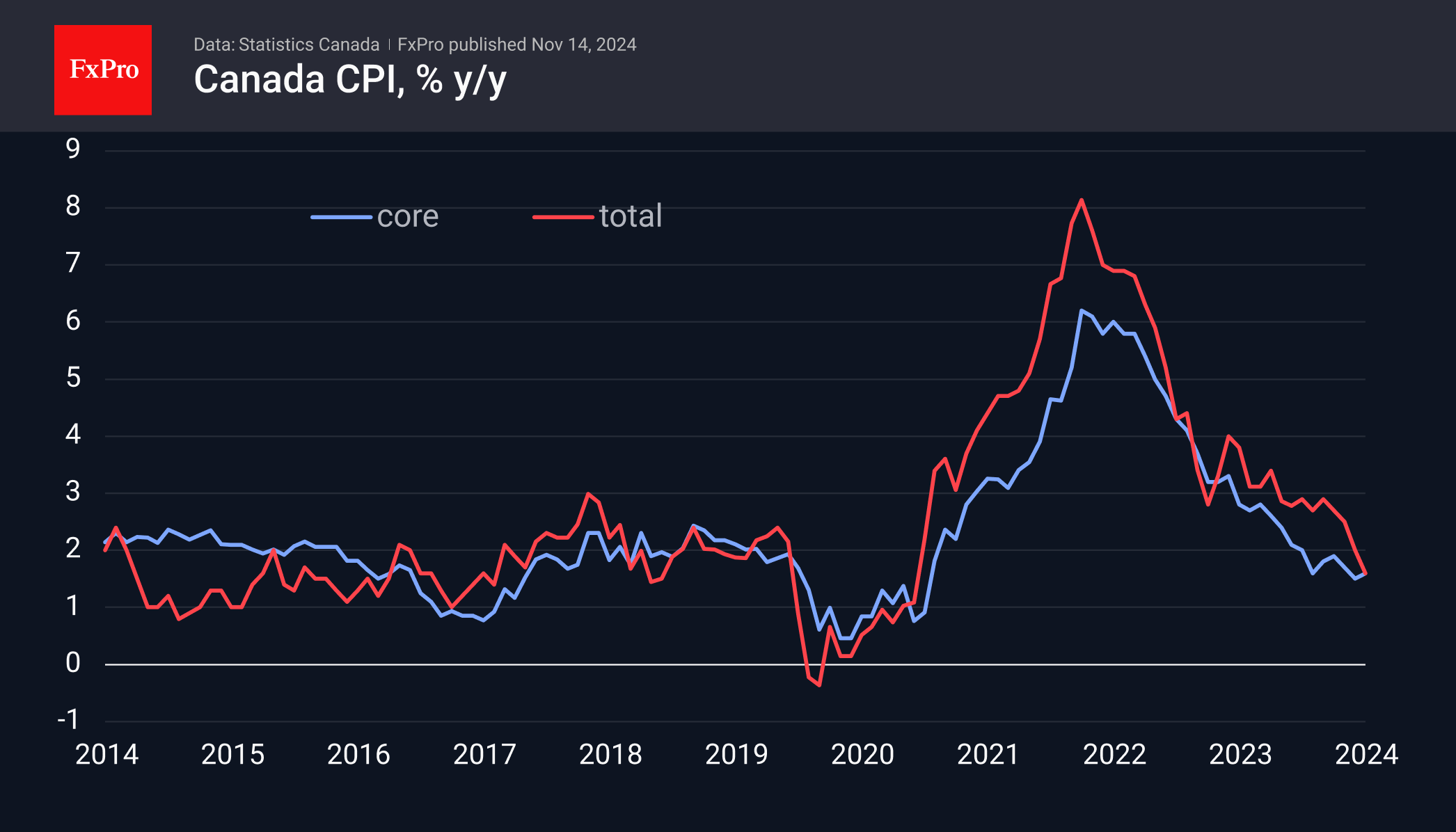

Canada will do so on Tuesday. The pace of price increases here is below the 2% target, allowing the Bank of Canada to cut interest rates by 50 basis points at the end of October. But how will the economy react to the 4% drop in the Canadian dollar against the US dollar since the beginning of October? With USDCAD reaching 1.40, its highest level since 2020, traders will also be keeping a close eye on inflation data.

The UK will release its inflation figures on Wednesday. Here, headline inflation is well below 2%, with core inflation, which excludes food and energy, hovering between 3.2-3.5% and 3.5% for the past five months. This is despite the negative annual rate of producer prices due to the impact of services prices.

The Japanese inflation estimate will be released on November 22nd, which may also play a key role in the future dynamics of the Yen and the Bank of Japan’s sentiment.

In the European session, all eyes will be on the preliminary business activity estimates for November. The release of the PMI indices often causes volatility in the Euro, and this time, it may determine the fate of the single currency for the next month.