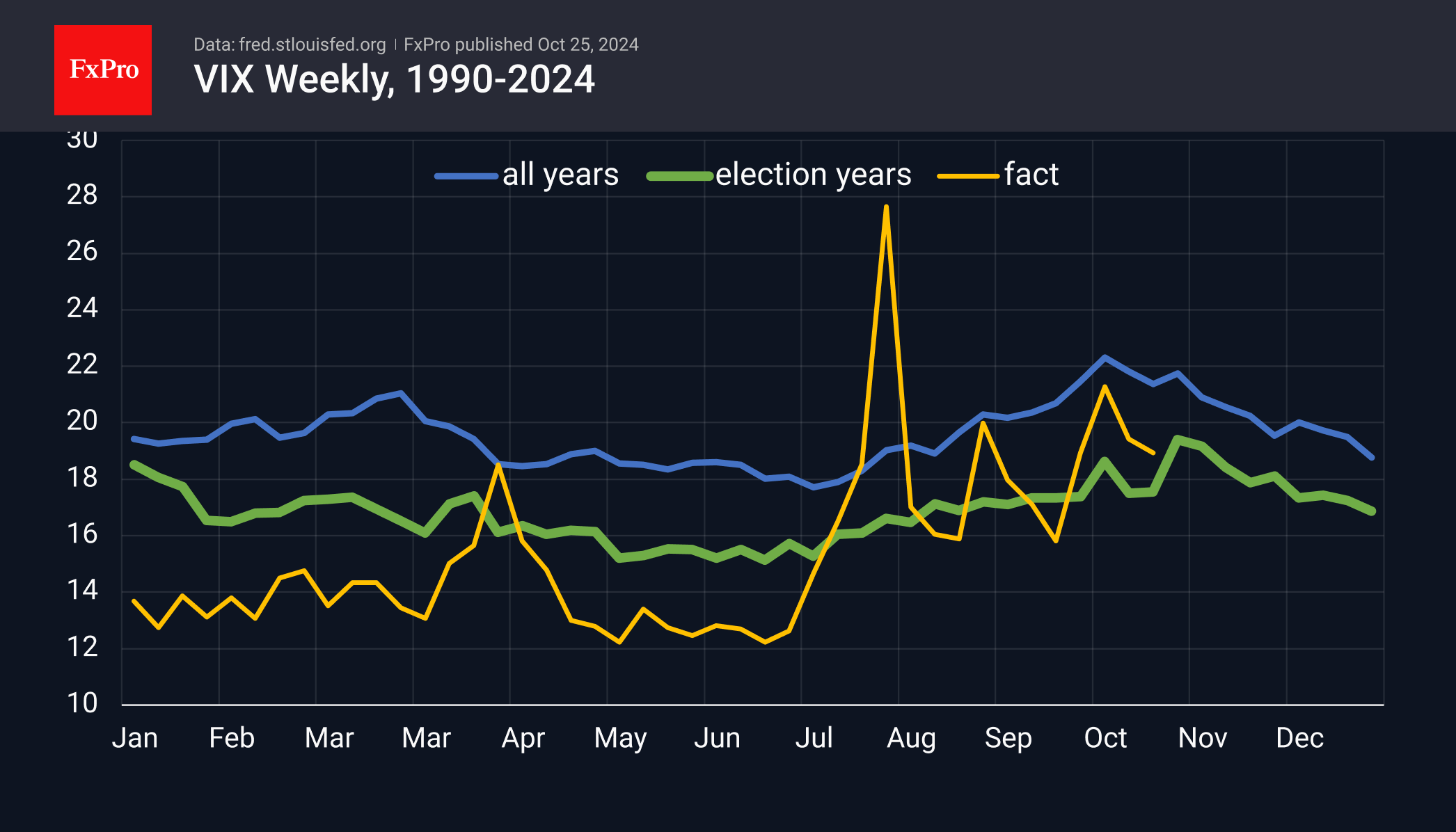

Seasonal patterns in the VIX, often referred to as the market’s fear gauge, indicate that volatility during this election year is likely to peak in the coming weeks, so be prepared for moves against established trends.

Looking ahead, consumer inflation data from Australia and Germany will be released on Wednesday. Initial estimates of third-quarter GDP for the eurozone and the US are also significant, as they could greatly influence the central bank’s views on interest rates.

The Bank of Japan will decide on interest rates on Thursday. Expectations have shifted towards ‘no change’ in recent days, putting pressure on the yen. However, the promise of further rate hikes could revive interest in the Japanese currency.

Friday will be the highlight of the week for the US markets, thanks to the October employment report. Throughout the week, the markets and we will be monitoring indirect indicators to assess the situation early.