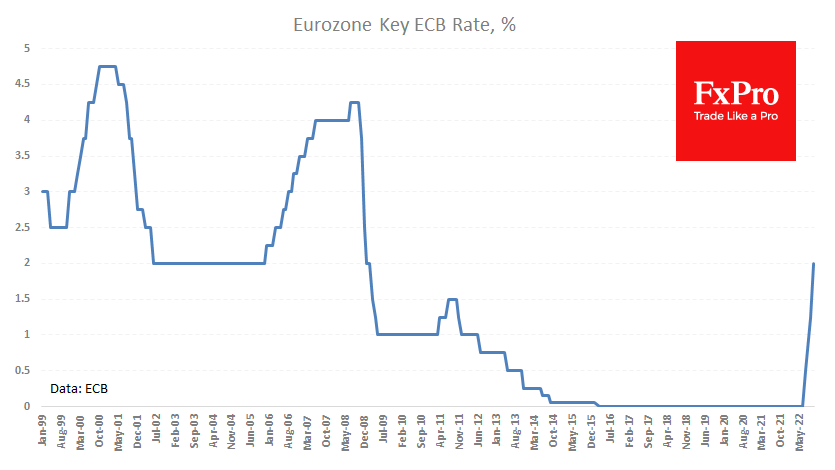

As most observers assumed, the ECB raised its key rate by 75 points to 2.0%. These are low rates by modern standards, but the eurozone last saw such rates 14 years ago.

Furthermore, the central bank indicated its intention to withdraw liquidity from the banking system to combat record inflation. Amongst other signals, there is a comparatively dovish guide to further policy tightening. The ECB is signalling its intention to raise the rate further to ensure that inflation returns to the 2% target.

We recall that official inflation was 9.9% YoY in September, and average forecasts suggest a further, albeit slight, acceleration in October. Such a message, in our view, indicates that the ECB remains on the side of the economy and maintains a catch-up role regarding inflation and other CBs (excluding the Bank of Japan). The first impulsive market reaction was to sell the euro and European debt securities, sending EURUSD temporarily below parity.

Nevertheless, this is another signal in the piggy bank that key central banks are already coming out to slow the pace of rate hikes. The Bank of Canada did it yesterday, the Reserve Bank of Australia did it before that, the ECB warned of a slowdown today, and the Fed is signalling that along with a 75-point hike next week, we will hear a signal of further rate slowing.

Having seen a pullback in commodity and agricultural prices and having done some work on policy tightening, the key global central banks seem to be synchronising their policies and preparing to move to a finer tuning. This is a relatively positive shift for equity markets and an additional reason to correct the one-and-a-half-year rally in the dollar.

The FxPro Analyst Team