UK retail sales rose by 3.4% in January, mainly recovering from the previous month’s dip but showing very high volatility. Last month’s miss led to talk of a looming recession despite a strong labour market. The new data reduced the level of concern about stagnation, but it is too early to talk about a new impetus to consumption growth.

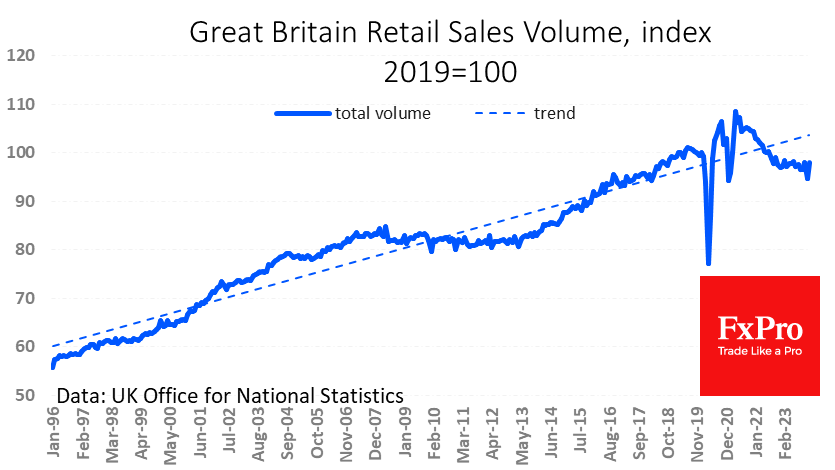

The current level of sales is 0.7% higher than in January last year. Moreover, the retail sales index has been hovering around its current level all this time, reflecting a prolonged period of stagnation. In the UK, retail sales stagnated between 2008 and 2013, following a period of above-trend growth. The unemployment rate was indeed around 8% at the time, compared with 3.8% today, which was close to cycle lows by historical standards.

It would not be surprising if, this time around, the retail sector were to go sideways for another year, cooled by high interest rates and the slowing stabilisation of price growth. Or, in the event of a contraction in the labour market, a further decline.

The latest retail sales figures, while beating expectations and easing worries about the UK economy, do not inspire long-term optimism. In terms of FX, this does not suggest a sustained strengthening of the Pound against its major rivals.

While GBPUSD got support on dips to its 200-day moving average, it will be complicated to develop an offensive from this point. In all the time since November that the GBPUSD has been above this trendline, it has failed to make gains and has remained under selling pressure.

Simply put, there is now a greater chance of a break below the 200-day and a consolidation below it, which would open the way to the 1.21 level we saw in October. However, if the problems in the UK economy continue to mount, a two-year decline towards 1.10 could begin.

The FxPro Analyst Team