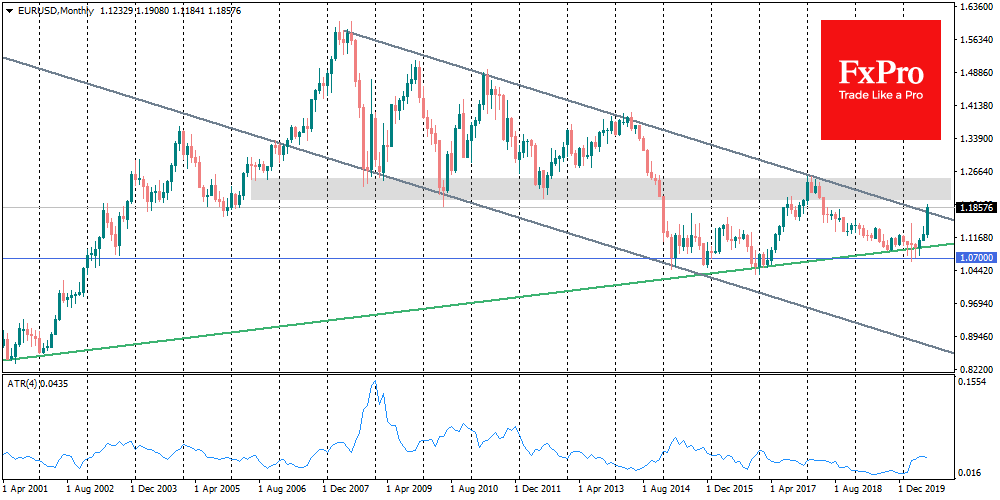

The EURUSD pair ends July at 1.1900. This is the third month of back-to-back growth and the highest values we have seen in more than two years. But its the pace of its climb that attracts even more attention. The jump of 6% is the eighth strongest monthly increase in the history of this currency pair since 1998 and the sharpest growth for ten years.

A significant increase in currency volatility is characterised by economic crises. This happens in both directions, as markets switch between periods of enthusiasm and despair. In the lists of the best and worst months for high fluctuation are the periods of 2000-2002 and 2008-2010. These are periods of economic, geopolitical and, consequently, exchanges disturbances. There is no doubt that 2020 has the potential to be such an event. Also, the increased volatility will almost certainly become a companion of the markets, not only this year but also next.

In addition to significant price movements, there are often big changes in the balance of power. In the context of EURUSD, in 2000-2001 the pair found it’s bottom, and in 2002 finally turned to growth, almost doubling its rate by 2008.

In 2008, the stage of systematic growth of the US currency against the euro began. This was due to the weak growth of the Euro-region as well as doubts of market participants that the United Europe project itself may suddenly collapse. These doubts are still alive today. With the first signs of discord between policymakers of European countries, commentators immediately raise the question of an imminent collapse of the EU and the eurozone.

European politicians are struggling to reach an agreement. The actions taken by authorities of different countries against the coronavirus turned out to be much more organised than in the USA. Of course, in the case of coronavirus, it is not easy to make predictions. However, the reopening of the European economy so far has led to a much smaller number of new diseases, which has a direct impact on the economy.

Earlier this week the Fed noted that the type and pace of economic recovery would be determined by the epidemic situation. The currency market, as a global remuneration mechanism, showed in recent months that the US is suffering considerably more than Europe.

This may be the beginning of a long process, which could launch a multi-year growth trend of EURUSD. It is difficult to say yet whether it will be a bumpy and very volatile movement like in 2008-2010 or whether we will see one powerful growth impulse after another, as occurred after 2001.

Probably, how the pair will behave at 1.2000 will help to answer this question. If the bears do not manage to create resistance in this area, the EURUSD might end the year at 1.2500, and there will be few doubts about the beginning of a multi-year decline of the American currency.

The FxPro Analyst Team