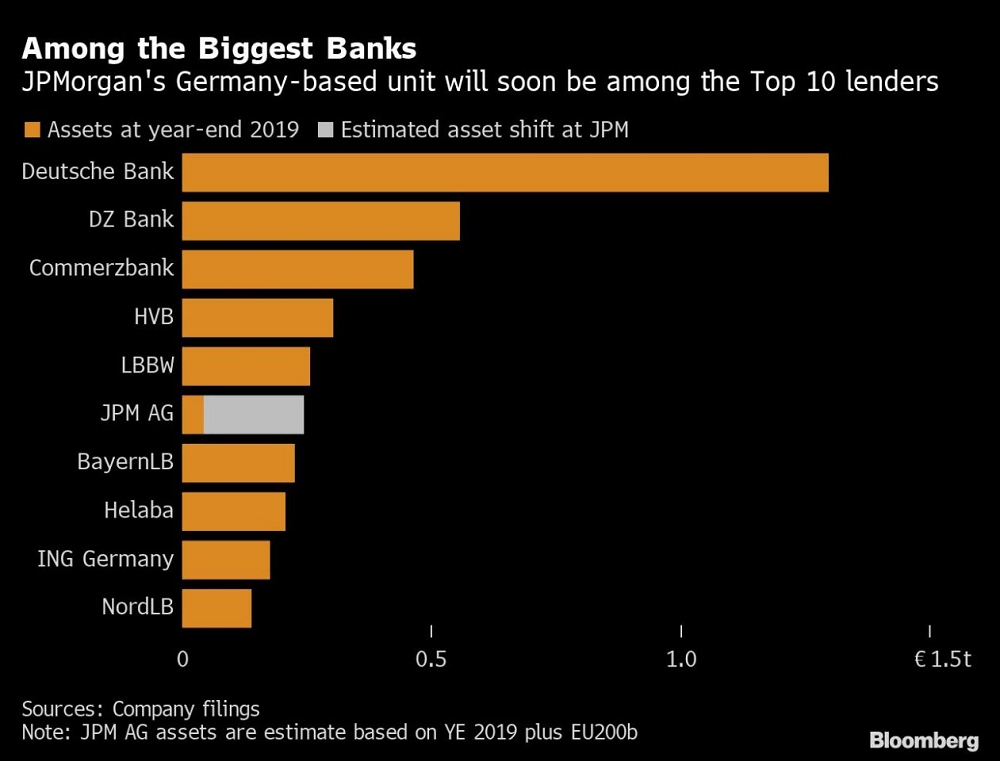

JPMorgan Chase & Co. is moving about 200 billion euros ($230 billion) from the U.K. to Frankfurt as a result of Britain’s exit from the European Union, a shift that will make it one of the largest banks in Germany. The U.S. bank plans to finish the migration of the assets to its Frankfurt-based subsidiary by the end of the year, people familiar with the matter said. The change could boost its balance sheet enough to become the country’s sixth-largest bank, based on the assets of the biggest commercial lenders last year.

The assets to be shifted represent slightly less than 10% of JPMorgan’s total balance sheet. It also represents almost half of the total assets held by German branches of foreign banks at the end of June, according to Bundesbank statistics. With less than four months to go until the Brexit transition period expires, international banks have been beefing up operations in the European Union to make sure they can service clients given the prospect that U.K.-based firms, including JPMorgan’s London operations, won’t retain passporting rights in a trade deal.

Given that increasingly likely prospect, the bank last week told about 200 London staff to move to continental European cities including Paris, Frankfurt, Milan and Madrid, Bloomberg News has reported. While JPMorgan has made the biggest shift to Frankfurt, other banks have chosen to bulk up in Germany’s financial hub, including Citigroup Inc., UBS Group AG and Standard Chartered Plc.

JPMorgan to Move $230 Billion Assets to Germany Under Brexit, Bloomberg, Sep 23