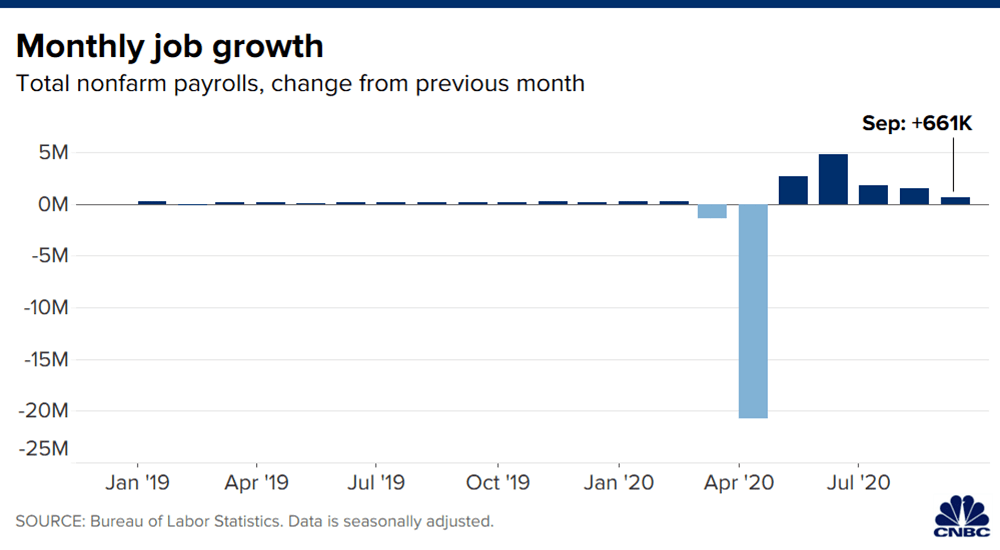

Nonfarm payrolls rose by a lower than expected 661,000 in September and the unemployment rate was 7.9%, the Labor Department said Friday in the final jobs report before the November election. Economists surveyed by Dow Jones had been expecting a payrolls gain of 800,000 and the unemployment rate to fall to 8.2% from 8.4% in August. The payrolls miss was due largely to a drop in government hiring as at-home schooling continued and Census jobs fell.

The decline in the unemployment rate came along with a 0.3 percentage point drop in the labor force participation rate to 61.4%, representing a decline of nearly 700,000. However, a separate, more encompassing measure that counts discouraged workers and those working part-time for economic reasons also saw a notable decline, falling from 14.2% to 12.8%. The unemployment decline for Blacks was even sharper than the headline rate, falling from 13% to 12.1%. The Asian rate declined from 10.7% to 8.9%.

Leisure and hospitality led job gains with 318,000 while retail added 142,000 and health care and social assistance increased by 108,000.

As expected, government was the biggest drag on the month, losing 216,000 due to a drop in local and state government education as many schools maintained at-home instruction due to the virus. A reduction in Census workers also pulled 34,000 from the total. In other sectors, health care and social assistance gained 108,000, professional and business services contributed 89,000 and the transportation and warehousing sector was up 74,000. Manufacturing grew by 66,000, financial activities added 37,000 and the other services category rose by 36,000.

Average hourly earnings were little changed over the month but still about 4.6% higher than a year ago. However, hourly comparisons are difficult in the current environment considering the virus impact and the continued tendency of higher-wage workers returning to their jobs before those on the lower end.

Jobs report shows fewer hires as recovery loses momentum, CNBC, Oct 2