Weekly US jobless claims data is attracting the most interest from investors and traders when it precedes the publication of the monthly payroll report.

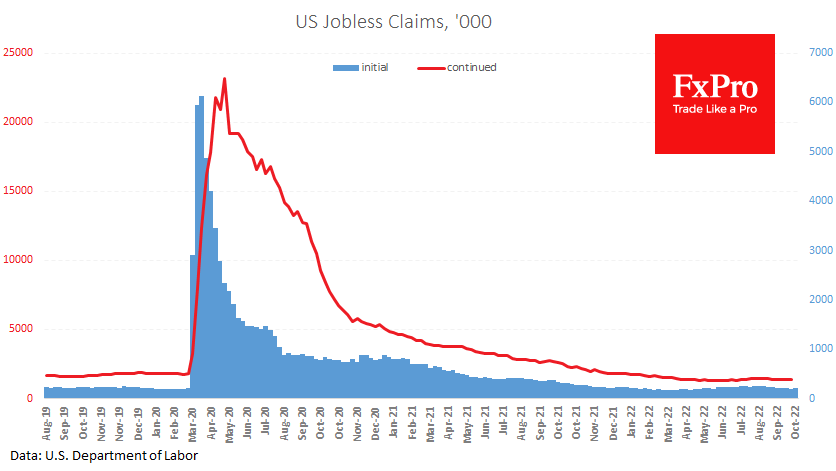

Today’s released data came in below expectations, showing 219K Initial Claims for the previous week against 190K a week earlier, and 205K predicted. The number of Continued jobless claims rose from 1346K to 1361K, and the forecasted decline to 1345K.

However, we also note that last week’s data was out of trend and unusually strong. The four-week average of initial claims fell to 206.5K from 230K a month earlier, and in the recaps, we see a four-week decline from 1421K to 1371K, which sets up for a further strengthening in employment.

Markets have drawn attention to a sharp, more than 1 million drop in job openings in August. At the same time, the total number remains abnormally high and indicates that the market is returning to normal but not to layoffs.

Bottom line: In our view, jobless claims point to a continued boom in the US labour market. This could be an obstacle for the stock market, which has been rejoicing over weak data lately on speculation that this will force the Fed to slow down rate hikes.

The FxPro Analyst Team