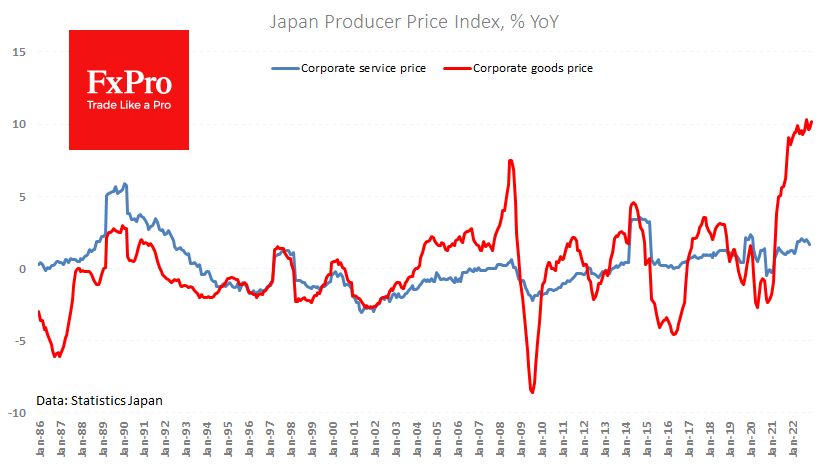

Japan’s Domestic Corporate Goods Price Index rose 0.5% m/m and 10.2% y/y in December after 0.8% m/m and 9.7% y/y. This is near the peak of 10.3% set in September. Despite lower commodity prices, prices are stubbornly reluctant to fall in Japan. And this is discouraging as more than one generation of economists has seen Japan as a prime example of deflation, citing demographics. We may continue to see a secondary effect of the yen weakening.

The Bank of Japan has halted the yen’s weakening spiral by reversing about half of the losses since the start of 2021. Nevertheless, increased exchange rate volatility pushes sellers to impose higher margins on prices, which prolongs inflationary pressures and risks triggering the price-wage spiral that every central bank in the world fears.

With this kind of resilience in inflation, investors expect to see a tougher central bank stance. From that point of view, it is logical that the Bank of Japan has had to go out with record purchases of Japanese government bonds in recent days to keep their yields from rising.

However, rising government bond yields are increasing pressure on the budget. There are doubts about the sustainability of the Japanese finance ministry, given the country’s massive national debt, chronic budget deficit and sluggish economic growth.

The BoJ remains the only central bank to maintain negative interest rates, probably out of fear of triggering unnecessary pressure on the economy. Therefore, with double interest, we should watch for the decisions and comments of the BoJ on Wednesday morning, where no options can be ruled out.

We could see a decisive turnaround from the policy targeting government bond yields and even a key rate hike. If that is the case, the yen could continue to strengthen towards 120 before the end of the first quarter.

The opposite surprise cannot be ruled out when the central bank strengthens its negative rate policy and puts the yen back on a sustained downward path. This turnaround could be particularly dramatic for the currency as market prospects are now skewed towards an expectation of tighter policy, albeit less dramatically than we see in the USA or the Eurozone. In that case, the USDJPY might hit 133 very quickly and then aim for 140 before the end of March.

A dull scenario is also possible if the BoJ balances out its signals and does not cause market turbulence as it did at its last meeting in December. The inflation picture is pointing towards a policy-tightening option despite the risks of losses for the economy.

The FxPro Analyst Team