The Japanese Yen has lost 2.3% against the US dollar since the end of last week, roughly twice as much as the rise in the dollar index against a basket of six developed market currencies. This change is due to a shift in interest rate expectations, with investors increasingly doubting an imminent rate hike in Japan and seeing fewer rate cuts from the Fed next year.

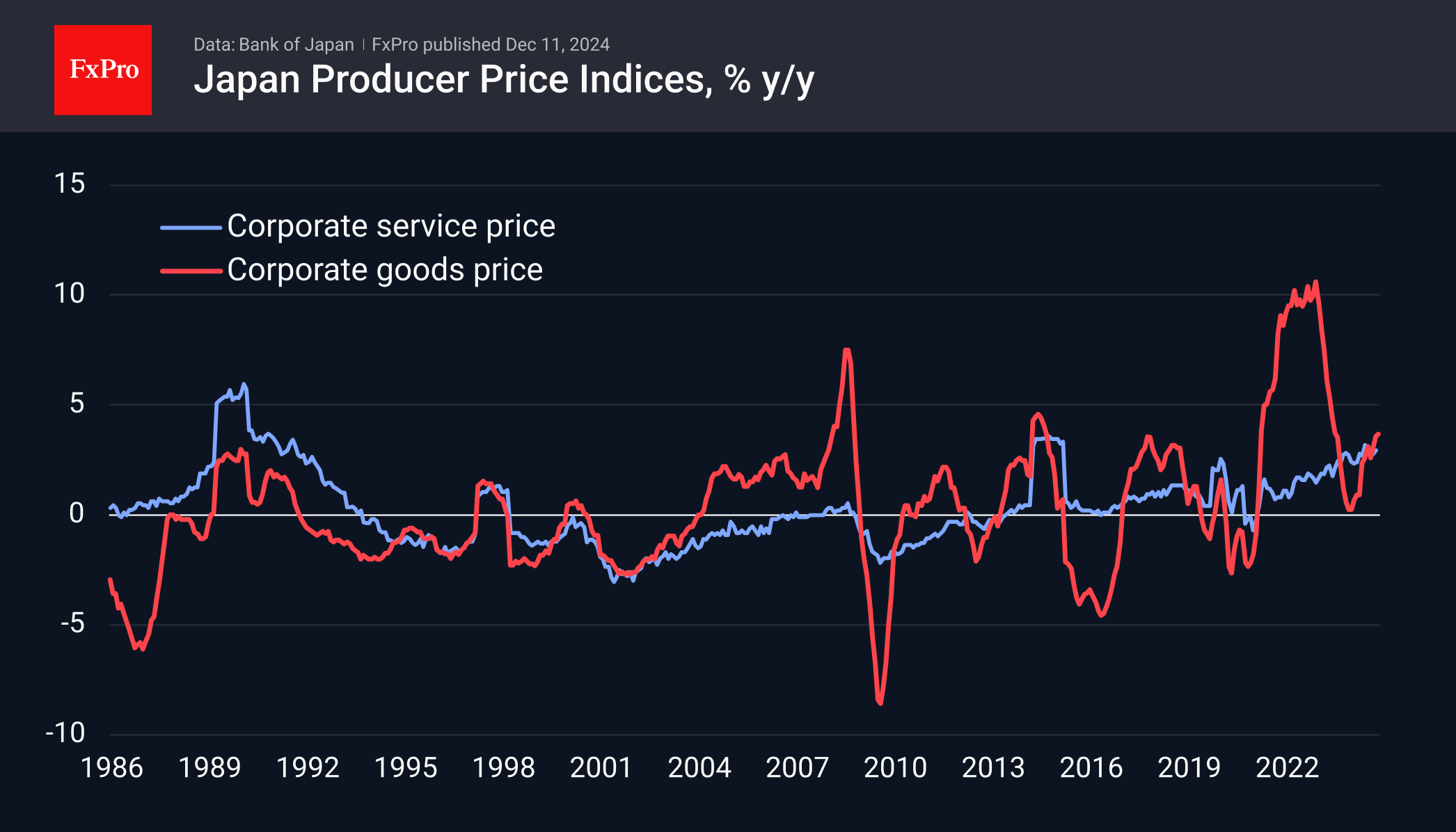

Interestingly, the latest inflation data does not help the Yen. November data showed an acceleration in Japanese business input prices to 3.7% y/y, the highest since the middle of last year. Corporate services price growth (October data) jumped 0.8% m/m to an annualised pace of 2.9%, maintaining levels near 3% y/y since April. These indices are important leading indicators of inflation, pointing to increasing pressure on retail prices and supporting a policy rate hike by the Bank of Japan.

At the same time, the decline in core consumer inflation to 1.5%, as tracked by the BoJ, provides room to delay policy tightening. The BoJ can use this time to assess the economic outlook considering potential trade tariffs from the Trump administration.

For the bond markets, this slowness has the effect of pushing back expectations for a rate hike in Japan from mid-December to the end of January. For currency markets, this puts pressure on the JPY as accelerating inflation that does not lead to a rate hike leads to capital outflows from yen debt markets.

It would not be surprising to see an accelerated rise in the USDJPY. The technical picture has also turned bullish in recent days, as the pair has broken above its 200 and 50-day moving averages. In addition, a “golden cross” is forming as the 50-day is about to cross above the 200-day, which is a strong technical signal for further upside. The USDJPY could potentially reach levels of 156 before the end of the year and exceed 160 in the first quarter of 2025.

The FxPro Analyst Team