For the first time in Japan, a woman has become prime minister. Although this result was largely anticipated, lingering risks led to a noticeable market response. However, the overall effect so far has been to sell Japanese assets, from the yen to stocks.

Takaichi’s position (stimulating the economy and lowering interest rates) has led to speculative buying in Japanese stocks. From its lows in early October, the Nikkei 225 has risen by almost 13% and on Tuesday morning was on the verge of reaching 50,000. As it approached this psychologically important round level, a wave of profit-taking pushed the index down to 49,000 during the day. However, this technical sell-off has not yet changed the long-term positive outlook for the market. Takaichi is expected to intensify efforts to stimulate economic growth, focusing less on the budget balance and accumulated public debt.

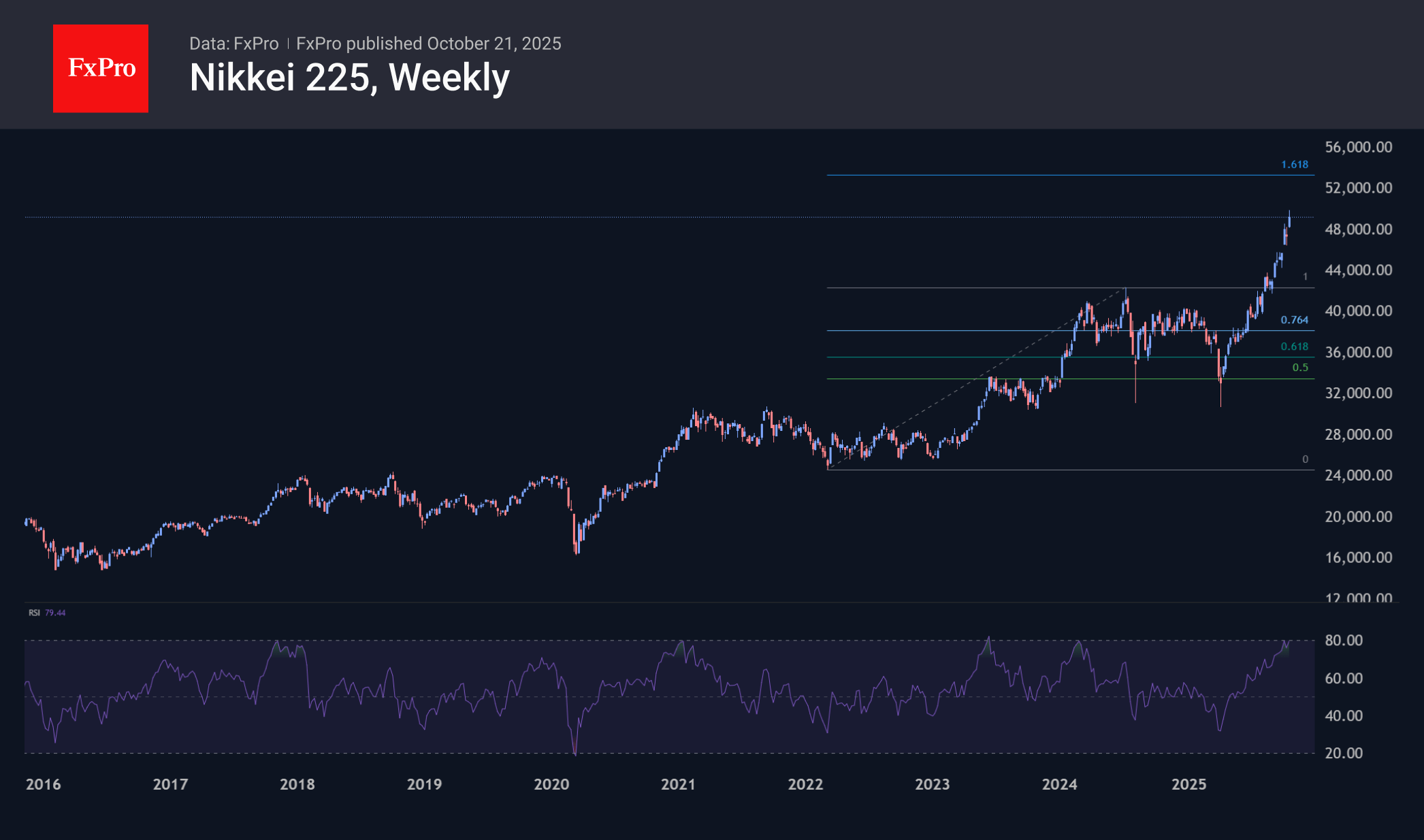

On weekly timeframes, the Nikkei225 is close to, but has not yet entered, the overbought zone on the RSI. Over the past 10 years, powerful corrections after rallies have occurred when the index was close to 80, and now it is at 75. Overall, these are relatively high values, but in such cases, rallies often become extreme, knocking out the positions of early sellers. It should come as no surprise that the index has risen to 52-53 thousand, which is closer to the typical rally range in Japan in recent years and corresponds to 161.8% of the 1.5-year rise by mid-2024.

USDJPY has gained about 5% since the beginning of October, before recently giving up half of its gains. However, since the end of last week, buyers have pushed the pair below 150, which prepares us for the yen to stabilise at a new level. The Bank of Japan confirmed in its recent comments its readiness to raise rates (which worked to lower the pair), but the latest comments postpone this event further into the future.

The events of October accelerated the USDJPY growth trend, which may reach its peak in the 158-160 range. At these levels, the market reversed in July 2024 and January 2025, not without the help of the Bank of Japan. However, there is a small chance that USDJPY will break through this resistance zone, given the changed political landscape. In this case, the technical target will be the 200 yen per dollar area, which is a logical continuation of the 2021–2024 growth momentum.

The FxPro Analyst Team