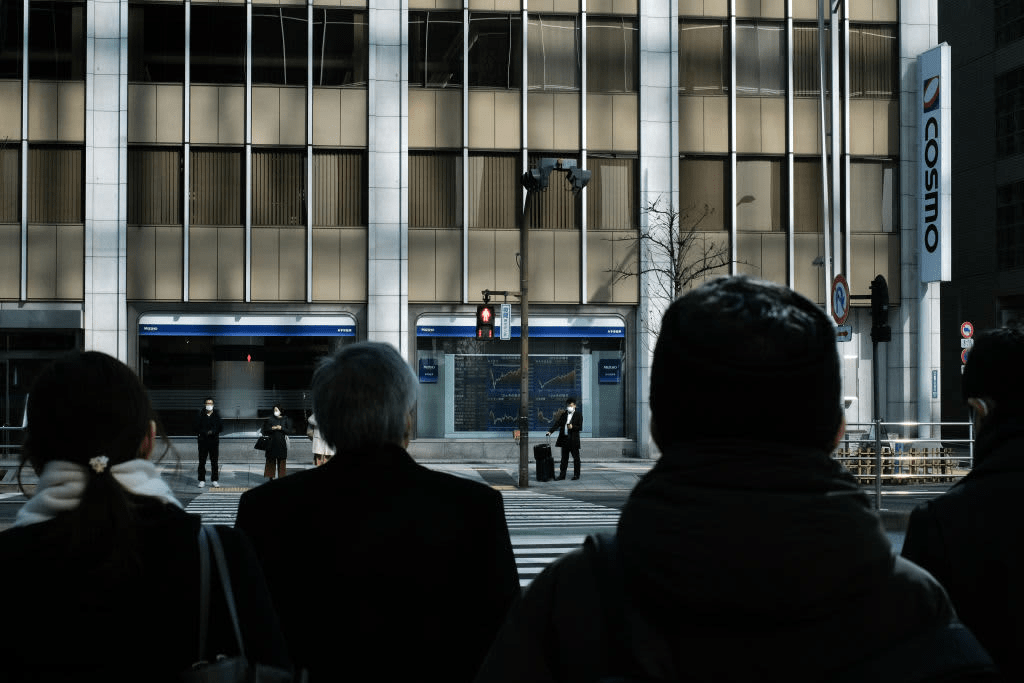

Shares in Japan climbed in Monday afternoon trade, as many major Asia-Pacific markets are closed for holidays. In Japan, the Nikkei 225 rose 0.91% while the Topix index advanced 0.66%. South Korea’s Kospi hovered above the flatline. Shares of LG Electronics climbed about 0.6%. The firm announced Monday that it is closing its mobile business unit to focus resources in “growth areas” such as electric vehicle components. MSCI’s broadest index of Asia-Pacific shares outside Japan traded little changed.

Markets in Australia, mainland China and Hong Kong are closed on Monday for holidays. In economic developments, the U.S. Labor Department reported Friday that nonfarm payrolls rose by 916,000 in March — well above the 675,000 increase expected by economists surveyed by Dow Jones.

The unemployment rate also declined to 6%, in line with the expectations of the economists surveyed by Dow Jones. The U.S. dollar index, which tracks the greenback against a basket of its peers, was at 92.942 — off levels above 93.3 seen late last month. The Japanese yen traded at 110.57 per dollar, weaker than levels around 110.5 against the greenback seen last week. The Australian dollar changed hands at $0.7619, above levels below $0.756 seen last week.

Japan stocks rise about 1% as major markets in Asia-Pacific are closed for holidays, CNBC, Apr 5