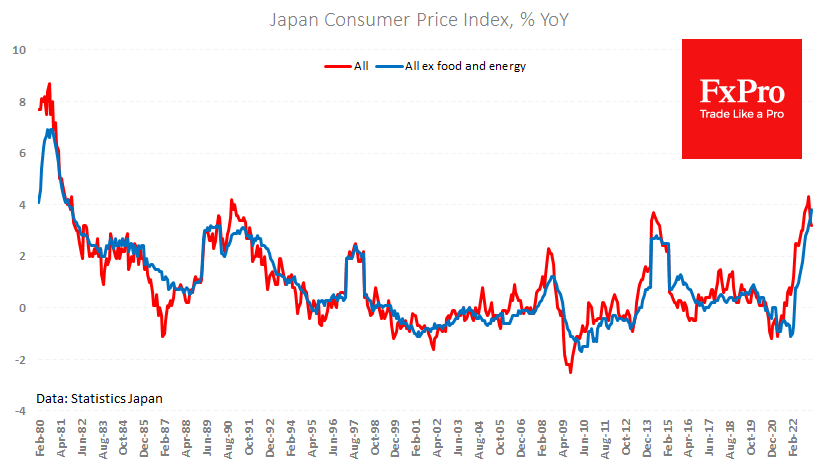

Consumer price inflation in Japan is in no hurry to slow down. In March, prices rose 3.2% y/y, compared with 3.3% in February and an expected 2.6%.

The core price index excludes food and energy but has not yet peaked, reaching 3.8% y/y from 3.5% the previous month. The last time core inflation was this high in Japan was in 1981. Worse, this index has risen by 0.6% in just one month without any visible slowdown, as we see in most developed countries.

However, the situation calls for patience rather than immediate intervention. The Corporate Goods Price index slowed to 7.2% YoY in March, down from 8.3% in February and a peak of 10.6% in December. We will see the Corporate Service Price Index next Tuesday, but the February pace was 1.8%, well within the inflation target.

For forex traders, higher-than-expected inflation is often a reason to buy currencies (in our case, sell USDJPY). However, with the overall growth rate in consumer and producer prices have peaked without active intervention from the BoJ, we should not expect the central bank to warm to raising interest rates now.

This interest rate differential between Japan and the rest of the world is working against the Yen.

From October 2022 to January 2023, the USDJPY gave back 50% of its rally from January 2021. Since then, the pair has returned to the upside. And we expect this moderate uptrend to prevail until interest rate cuts begin in the US and Europe.

The FxPro Analyst Team