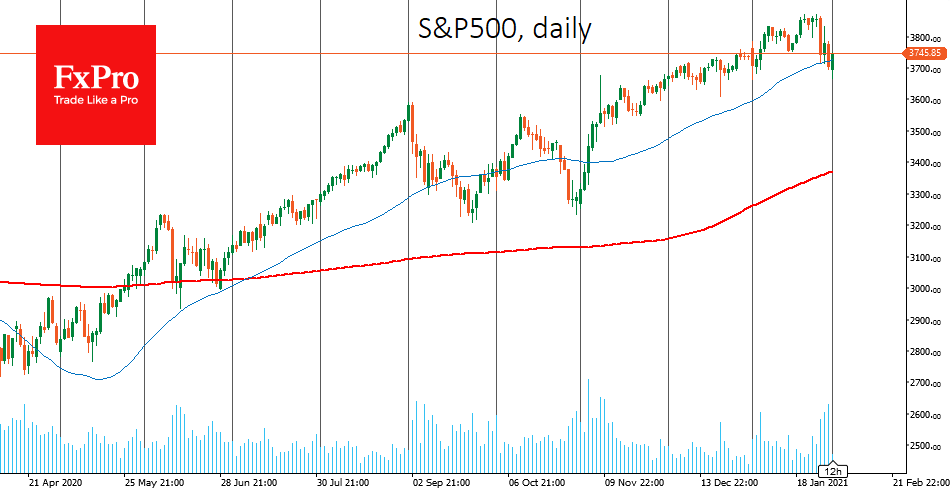

Global markets are starting a new month with a strong rally, showing a recovery in risk demand after a dip at the end of January. The Dow Jones index futures are back above 30K, and the S&P500 is above 3700.

However, in both cases, indices remain under the 50-day average, potentially reflecting a break of the last months’ short-term upward trend. The monthly candles close of the key US indices also look worrisome as the S&P500, Dow Jones and Nasdaq formed a “shooting star” pattern. We see the same reversal pattern on many other indices.

Despite the positive start of trading on Monday, it is still worth watching out for near-term prospects for the indices, as the news background does not yet indicate any new optimisms. Contrary to expectations, there is no consensus among US lawmakers on the $1.9 trillion support package. There are increasing calls to discuss halving the bailout.

Vaccine distribution continues to face difficulties. Israel’s case suggests that even with abundant vaccination, the medical system is rapidly approaching the tipping point without strict lockdowns.

Much of the good news and hopes have already been priced into the market. At the same time, worrying information can reinforce profit-taking and deepen the correction.

Today, as markets are trying to rebound from the local lows, it is worth observing to see if indices manage to return above the 50-day averages.

If they succeed, it would indicate buyers’ strength and an increased buying activity during the declines.

A pullback, however, looks more likely, potentially turning the former support into resistance. The 200-day average lines could become a technical target for a correction for the three major US indices.

Buying at these levels is justified by the continued ultra-soft monetary policy of the key central banks. Moreover, a decline in these averages will generate enough noise in the markets, managing to attract regulators and lawmakers, who now prefer to keep new stimulus from markets and the economy. For S&P500, this opens up the potential for a 10% decline from current levels, versus 8.2% for Dow Jones and 13.7% for Nasdaq100.

The FxPro Analyst Team