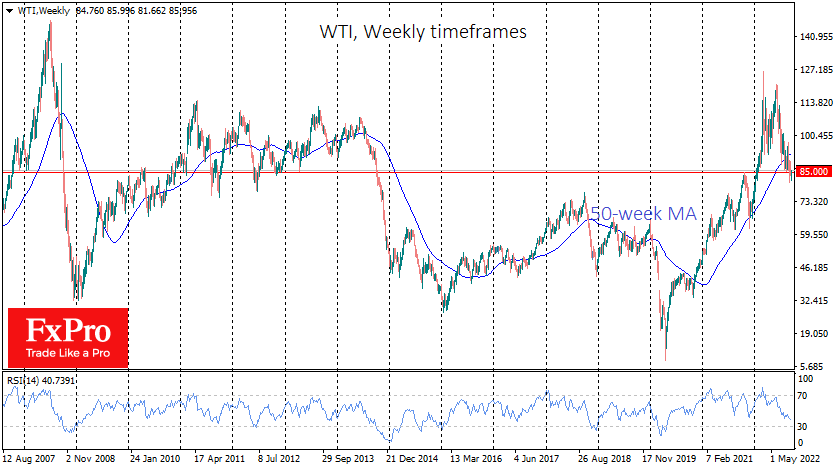

WTI oil suffered an intraday drop of more than 4.5% to $81.70 yesterday but managed to regain all losses by the end of the day, trading now at $85.40. The $85 area has repeatedly acted as the Rubicon since 2007.

In 2008, the failure was provided by the near collapse of the financial system. Oil only fell below that level after the bankruptcy of Lehman. At that time, oil didn’t get firm footing until $35.

In 2014, the world feared a then unknown “tapering” from the Fed, but Saudi Arabia had the final knockdown for prices, temporarily switching to fight for oil market share. A return to the firm ‘quota’ policy, but now with Russia, did not occur until early 2016, and prices went as low as $30.

On the other hand, we saw prices steadily above $85 between 2010 and 2014, when the global economy was recovering strongly from oil consumption thanks to stimulus and near-zero interest rates. In 2022, the move above resulted from Europe’s severe energy crisis and fears of production cuts due to Russia’s rapid oil abandonment.

And now, the price remains above that level, despite heightened equity market volatility and a stronger dollar in forex. However, these are the most influential factors affecting the price.

A high-profile event or shock in geopolitics or financial markets could break the steady support of oil buyers on the downturn in the coming days. For example, it could be a new round of tightening Fed rhetoric consisting of a 100-point rate hike at once or a hint of further hikes as long as the rate markedly exceeds inflation.

The converse cannot be ruled out either: the Fed could hint at a move to more fine-tuning policy in the future, promising less harsh decisions. Such a bullish market reversal could validate fundamental price support at current levels.

However, knowing how central bankers like to leave all doors open, it is also worth being prepared for the Fed to try to soften the effect on the markets by extending the period of uncertainty as much as possible.

In the latter case, geopolitics could prove decisive. However, there are still no clear signals of a change in the geopolitical setup around the energy market. Gas prices in Europe and the USA have retreated from their highs; OPEC+ made a symbolic move in early September by limiting production, and the USA continues to sell off reserves.

The FxPro Analyst Team