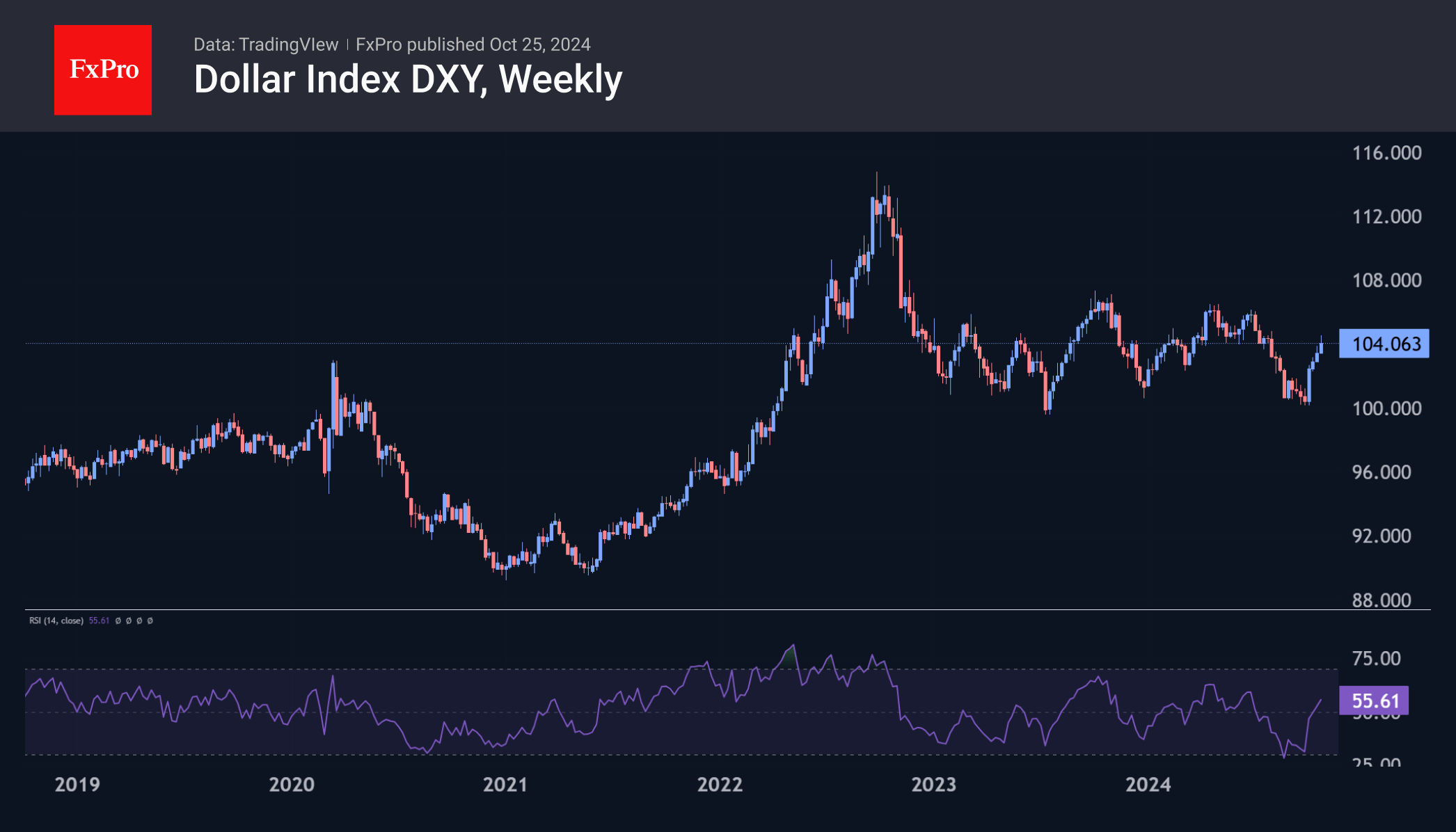

The Dollar Index has climbed 4.5% over the past four weeks, a movement that’s not unusual compared to longer and sharper rallies in recent years.

However, what stands out is that equities and gold are also on the rise alongside it. It’s probably more accurate to talk about a decline in competitors rather than a strengthening of the dollar.

The drop in U.S. bond prices (reflected in rising yields) supports the hypothesis and rejects the idea of a craving for defensive assets.

By the end of the week, this craving had abated somewhat, leading to a fall in risky assets and a correction in the dollar. Traders are de-risking and consolidating ahead of a series of important market events in early November.

There are three potential technical targets for the USD pullback from the current level of 104. The first is the 200-day moving average at 103.8. The second is the intermediate Fibonacci retracement level of 76.8% of the advance at 103.33. The third is the classic 61.8% retracement to 102.7.

The FxPro Analyst Team