The Israeli government made “very serious mistakes” after initially containing the coronavirus outbreak, and “tremendous damage” is being done to the economy, a political analyst told CNBC as cases in the country continue to climb rapidly. Just weeks after restrictions were mostly lifted in late May, new infections have led authorities to reimpose measures including closing gyms, clubs and event halls. Certain parts of the country were also designated as “restricted areas,” where business activity will be limited.

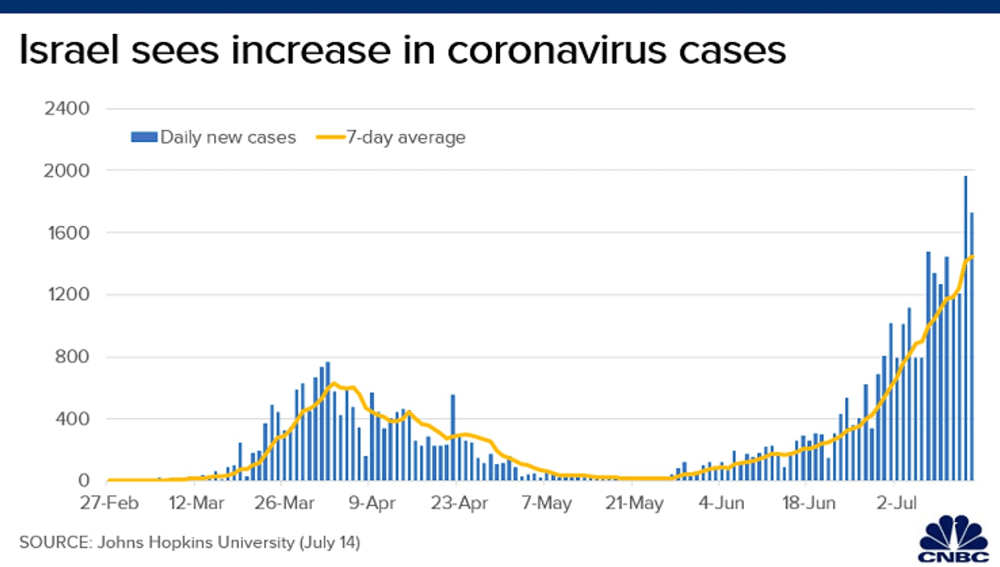

Daily cases fell as low as single digits after Israel took action in March, closing borders and tightening measures that restricted movement and gatherings. Following some success in controlling the health crisis, activity was allowed to restart, but cases started surging again, reaching new daily highs this month.

Israel has reported 42,360 confirmed cases and 371 deaths, according to data compiled by the Johns Hopkins University. Local media reports said thousands of demonstrators have come out to protest against the government’s economic response to the coronavirus crisis. Unemployment in the country jumped to 21% and economic aid has been slow, Reuters reported.

Siegal Sadetzki, the country’s public health director, resigned last week, saying Israel had “lost its bearings” in handling the pandemic, according to a Reuters translation of her Facebook statement made in Hebrew. “The achievements in dealing with the first wave (of infections) were canceled out by the broad and swift opening of the economy” that outpaced many other countries, she wrote.

Israel’s leader is starting to pay a ‘political price’ as virus cases surge, protests erupt, CNBC, Jul 15