The UK boasts an impressive population vaccination rate, which is already paying off: the number of new daily deaths from coronavirus fell by three times over the month and almost six times for new daily cases.

Therefore, the prospects of a complete lockdown lifting in the UK now look much more certain.

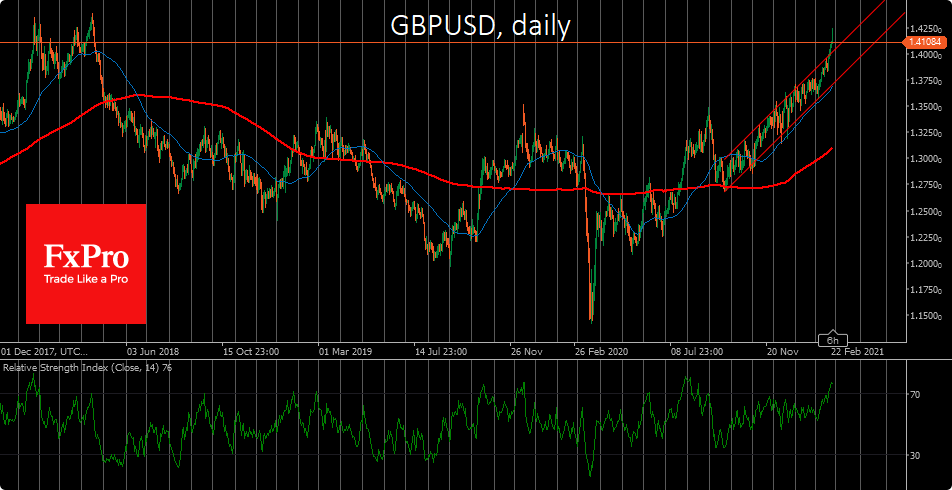

This has attracted speculative interest in the pound. GBPUSD went to 1.4237 this morning, having gained 5% in the last 20 days. The rise in the British currency is most resilient in crosses with the euro, franc and yen.

This morning there was a solid breakdown of stop orders, sending EURGBP below 0.8550 (-5% YTD), while GBPJPY was above 150 (+7.5% YTD) and GBPCHF was approaching close to 1.29 (+8.4% YTD).

The RSI index on the daily charts in these pairs exceeds 80 (20 for EURGBP), pointing to extreme overbought conditions for the pound. This very extended rally formed the base for a short-term correction, for the start of which a simple halt in the rise may be sufficient.

The FxPro Analyst Team