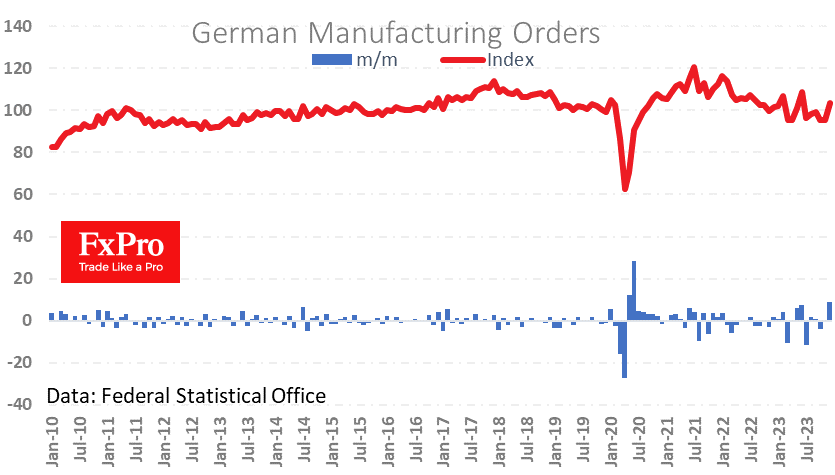

Industrial orders rose 8.9% in December against expectations for a 0.1% decline, a rare positive for Germany that the euro chose to ignore. This is the most robust monthly increase since mid-2020’s lockdowns.

In the same month last year, the increase was 2.7%. A positive year-over-year rate has been a rarity over the past two years, as a couple of spikes did not break the overall downtrend. Traders in European markets are likely looking for such an anomaly and ignoring today’s upbeat data. However, we may be seeing the result of a relatively long period of low gas prices, the effects of China’s stimulus and the economy’s adaptation after the inflationary shock.

So, suppose orders continue to rise next month. In that case, it promises to be a turnaround at a time when it seems that only the lazy have failed to talk about the deindustrialisation of the eurozone’s largest economy.

We will also be looking at German industrial production figures on Wednesday – will there be similarly strong growth? If so, markets may have rushed to bury the euro.

The FxPro Analyst Team