The last two weeks have been hectic for oil traders, who have had a rich extract of news and data from many directions, fuelling volatility but leaving the price at the same level as a fortnight ago.

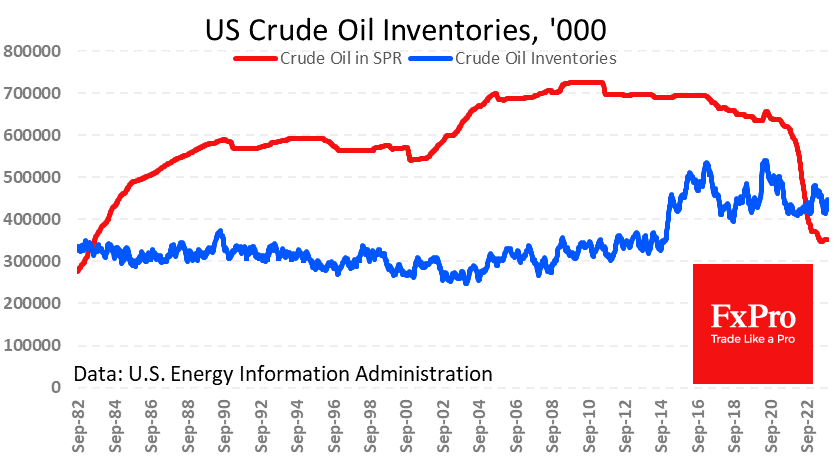

The fresh weekly EIA report marked another week of impressive growth in commercial inventories. They rose by 8.7m barrels for the week and 28.3m in five weeks of steady growth, and the current level is 3.8% higher than the same week a year ago. Meanwhile, the production rate of 13.2m bpd has been maintained for seven weeks. This appears sufficient for a small surplus, allowing to gradually rebuild inventories that have fallen over the past two years.

From a peak at the end of September, oil lost over 20% to last week’s lows on demand concerns and reports that OPEC+ supply was higher than previously estimated.

As a result of this downturn, the price of oil has returned to sensitive territory for the cartel, which yesterday announced the postponement of its scheduled meeting from 26th to 30th November. No changes to quotas were expected from the summit and monitoring committee meeting, but the postponement has raised the issue of solid opposition among OPEC members.

News of the postponement initially wiped over 5% off the intraday price, with WTI dropping to below $74.0 and Brent to $78.5 at one point, but prices soon returned to $76.5 and $81.5, respectively. The postponement of the meeting opens up the possibility that Saudi Arabia could push through voluntary cuts from other cartel members to reverse the trend.

Technical indicators also point to a battle for the trend in recent days.

The Bears have the 200-day average on their side. In early November, oil fell well below it. Two attempts to get back above it were met with waves of selling in WTI and Brent.

On the Bulls’ side, the downward momentum is waning. The Relative Strength Index on the daily chart shows a series of higher local lows despite lower local price lows. This divergence suggests that the bearish momentum has run its course, and the potential for a rebound or even a reversal to growth is building.

A sign of a reversal in the uptrend would be the ability of the price to return consistently above its 200-day moving average, which is close to $78 for WTI and $82 for Brent. However, it is prudent to remain on the sidelines until we get signals from OPEC+ officials, of which there could be many in the coming days.

The FxPro Analyst Team