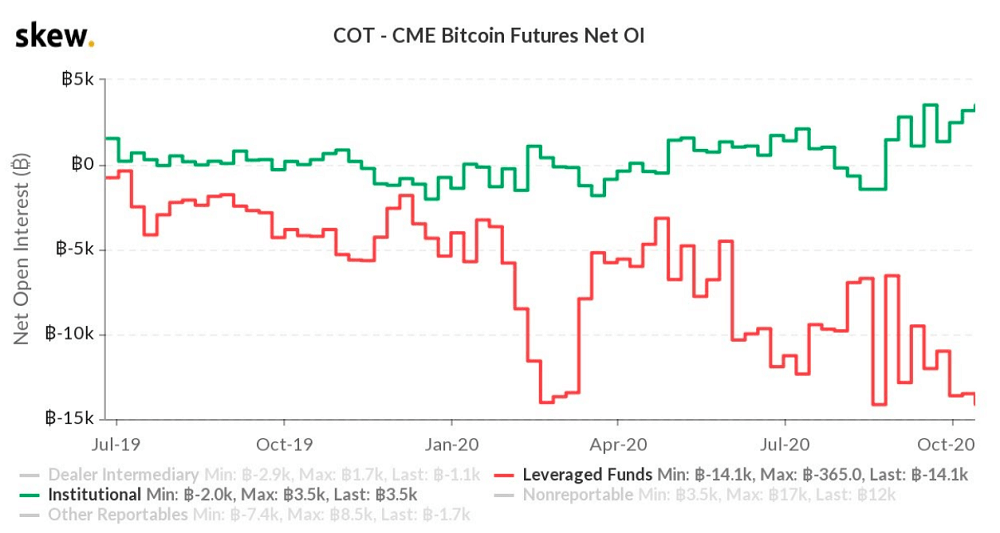

According to CME, the amount of Bitcoin (BTC) long contracts held by institutions are at an all-time high. Yet, CME’s most recent Commitment of Trader report shows hedge funds are at a record-high for BTC shorts. There seemingly is a major difference in the perception of Bitcoin’s short to medium-term trend between hedge funds and institutions.

Hedge funds typically implement varying strategies to generate returns for investors. Oftentimes, hedge funds will utilize derivatives and employ a more high-risk strategy. In contrast, institutional investors who are allocating a percentage of their portfolio to Bitcoin likely have a long-term strategy. This means they are not concerned about the short to medium-term performance of BTC.

Some analysts say that hedge funds are likely short on Bitcoin to provide liquidity to institutions longing the top cryptocurrency. When institutional investors increasingly build up their long positions, there need to be sellers on CME to balance the order book. Mitchell Nicholson, a cryptocurrency analyst, said: “Many HFs are likely shorting CME futures hedged to capture the basis or providing liquidity to the institutions going long.”

Technically, hedge funds might also be shorting Bitcoin after repeated rejections of a key resistance level. Bitcoin has been unable to break out of the $11,700 to $12,000 resistance range since August. For over two months, Bitcoin has been mostly ranging between $10,500 to $11,700, struggling to show upside momentum.

After BTC’s recovery from $3,600, hedge funds may be expecting a significant pullback.

On Oct. 17, Barry Silbert, the CEO of Grayscale, said the firm reached all-time high assets under management (AUM) at $6.4 billion. The figure from Grayscale is critical to measure institutional activity because their products mainly tailors institutional investors. In the U.S., there is not a Bitcoin exchange-traded fund (ETF) approved by the U.S. Securities and Exchange Commission (SEC). As such, institutions rely on the Grayscale Bitcoin Trust, which operates more like an exchange-traded product (ETP) to gain exposure to Bitcoin.

Institutional Bitcoin longs at record-high, hedge funds short — CME data, CoinTelegraph, Oct 20