Inflation in Turkey continues to gain momentum. A fresh set of monthly statistics showed consumer inflation accelerating to 79.6% y/y and producer inflation to 144.6% against 78.6% and 138.3% a month earlier, respectively. The rise in the PPI rate is a continuing adverse signal that the inflationary trend in CPI is unlikely to change over the next few months.

Meanwhile, monetary policy remains on hold as the central bank has kept its key rate unchanged at 14% since the end of last year.

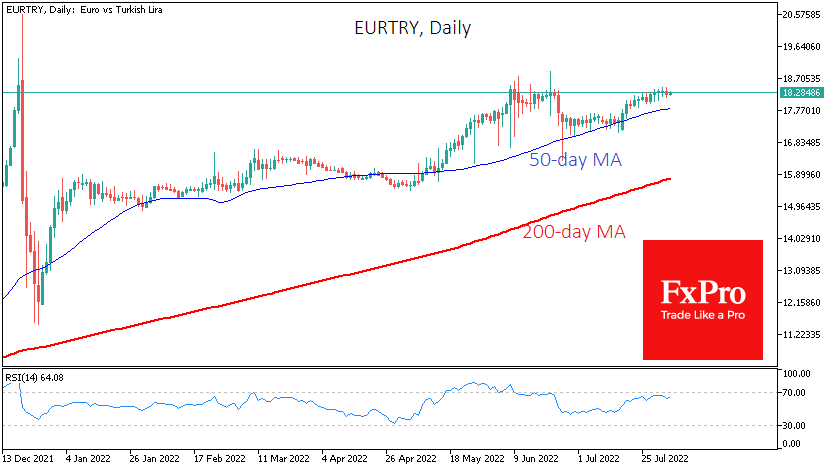

Increasing differences between inflation and key interest rates keep pressure on the Turkish lira, which is again trading around the lows of last December and June against the euro. Against the dollar, the lira has already updated the highs of June and is approaching 18.

The nature of the intraday movement in the lira indicates a somewhat artificial fluctuation in the highs, with an apparent hold on the historic lows.

However, it is worth realising that central bank interventions and tight capital controls are only effective in the short term to calm the panic. Such a confrontation usually ends in a one-off devaluation. But it is impossible to predict how long the Central Bank will resist the market.

The FxPro Analyst Team