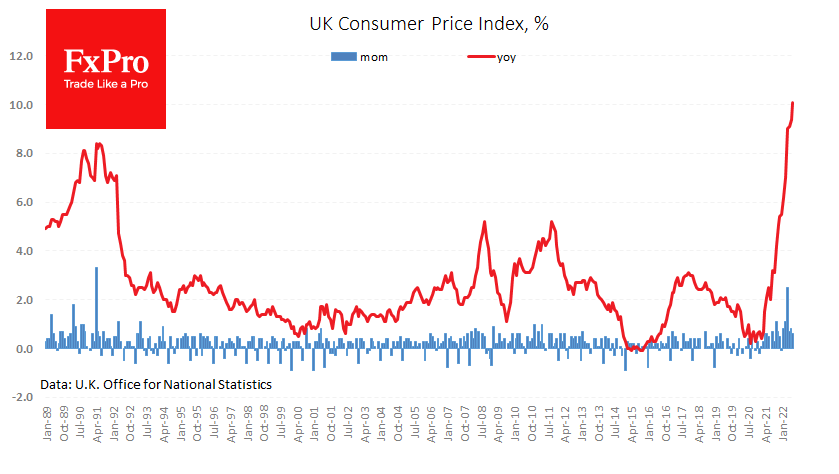

While economists in the US and Canada, and later policymakers, are talking about peak inflation, that moment is yet to come for the UK. Annual inflation has reached double-digit territory at 10.1%. At the same time, the monthly price growth rate remains elevated.

It is also important to note the spread of inflation beyond energy. The core CPI has accelerated from 5.8% to 6.2%, higher than the expected 5.9%, indicating an active consumer cost pass-through.

Retailers are finding it difficult to avoid as manufacturers raised their selling prices by 1.6% over July and have increased by 17.1% over the past 12 months.

However, one of the leading inflation indicators – the Input Producer Price Index – indicated light at the end of the tunnel. This indicator rose by only 0.1% in July, sharply below the forecasted 0.7%. The annual rate slowed down from 24.1% to 22.6%.

This cooling of the early price indicator further fuels confidence in the Bank of England’s forecasts that consumer inflation will peak in November and levels near 11%.

It is difficult for the Bank of England to maintain the same rate hikes as the Fed due to a less bright labour market picture, which thickens the cloud over the economic outlook. As a result, the British pound is under additional pressure, losing more than 12.5% to the dollar.

Historically, due to higher inflation in the UK compared to the US, GBPUSD has been dominated by a downtrend. Currently, the pair is testing the area near 1.20 for the fourth time in modern history. The difference in monetary policy potential and actual inflation data are set up that the GBPUSD will finally dip into lower territory in the coming weeks.

There is a considerable risk that, unlike the episodes of the last six years, this time, investors will not rush to buy the pound but will sell it out, repeating the 1984 dynamic. Having settled at 1.20 in November of that year, the pound plummeted to 1.05 in the next four months, and only Plaza Accord reversed the trend. But the big question now is whether the US need a new such accord.

The FxPro Analyst Team