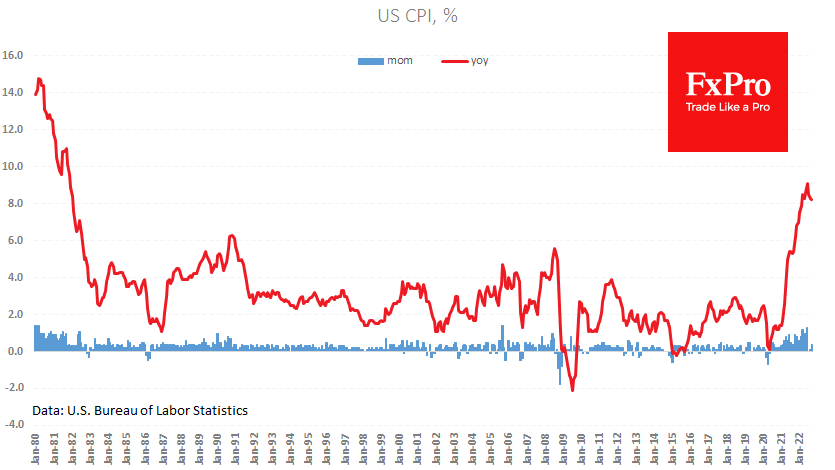

U.S. consumer prices added 0.4% in September, versus a forecast of 0.2% and an increase of 0.1% a month earlier. Annual inflation slowed from 8.3% to 8.2% versus the expected 8.1%. Yesterday’s more vital producer price readings suggested the possibility of such an outperformance.

However, the continued run-up in core inflation has caused a real market storm. Excluding food and energy prices, inflation accelerated from 6.3% to 6.6%, a new record since 1982. Suddenly it appeared that the peak of consumer inflation had not yet been passed.

While the markets viewed the Fed’s statements as aggressively hawkish, the inflation update sparked speculation that it could be worse. CME’s FedWatch Tool now lays out a 92% chance of a 75-point rate hike in early November, giving the remaining 8% chance of a 100-point tightening. We recall that since last Friday, the market had been pricing in an 18% chance of a 50-point rate hike and an 82% chance of a 75-point hike.

As a result of the rapid revaluation, Nasdaq100 futures have lost 3% since the beginning of the day and 4.5% from their peaks just before the release. This index has pulled back to July 2020 levels in the 10,500 area. The S&P500 pulled back to 3,500, making a frighteningly decisive move lower under the 200-week moving average. This key benchmark of U.S. markets erased all the gains made since Biden became president.

In the foreign exchange market, the dollar index returned to 113.50, a two-week high, 1 per cent below the 20-year highs posted late last month.

It again appears in the markets that inflation data could trigger a new wave of tightening rhetoric from the Fed, prompting everyone to expect higher rates and faster than previously estimated.

The FxPro Analyst Team