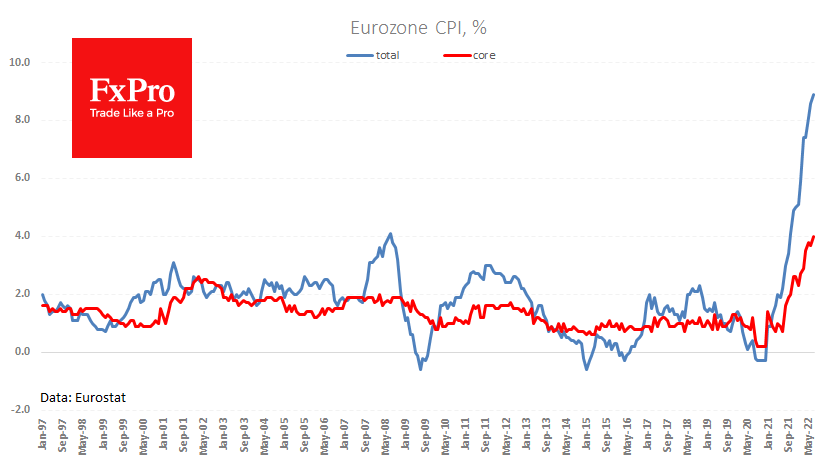

Inflation in the eurozone continues to speed up. Preliminary data for July showed a price increase of 8.9% against 8.6% a month earlier and the expected 8.7%. The core price index (which excludes energy and food) rose 4% y/y vs 3.7% a month earlier. Renewing the region’s historical record price increase rate would probably force the ECB to continue with a policy tightening.

In support of this argument, GDP figures for the second quarter were also significantly better than expected. The Euro-region economy added 0.7% in the quarter and 4% compared to the same quarter a year earlier, noticeably better than the forecasted 0.2% and 3.4%, respectively.

The typical reaction to such a combination of data would be for the euro to strengthen against a wide range of competitors. The reality so far turns out to be different, as currency market traders must factor in the already accumulated lag of the ECB in their quotes.

As a result, EURUSD continues to stomp around 1.0200 for the past ten days, while other major pairs have made a more decisive corrective rebound. Judging by market dynamics, the clouds over the euro are much heavier than the JPY, CHF, or GBP, not to mention the commodity-related CAD, AUD.

The FxPro Analyst Team