The US dollar strengthened, while the stock market came under pressure. Accelerating inflation reduced the chances of monetary policy easing.

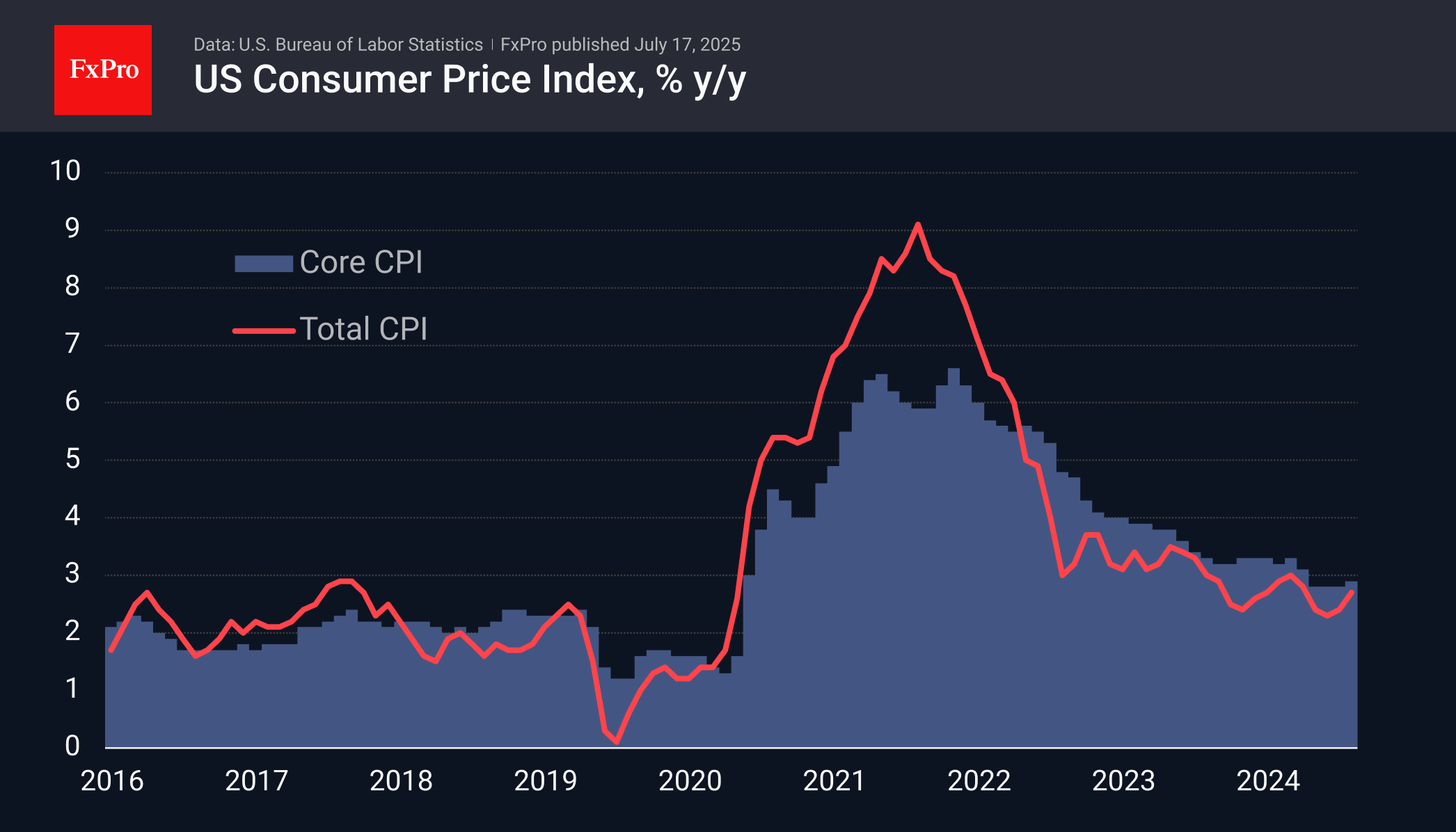

The overall price index rose 0.3% m/m and 2.7% y/y, accelerating from 0.1% m/m and 2.4% y/y a month earlier. Annual growth rates slightly exceeded expectations, accelerating for the second month in a row.

Core inflation accelerated in annual terms from 2.8% to 2.9%. Although forecasts were lower than average, this was the first acceleration in the indicator in the last ten months.

The market reaction to the report was not too intense, but we still saw a continuation of expectations for a tighter policy towards the end of the year. Interest rate futures give a 44% chance of rates remaining unchanged in July and September, compared to 29% a month earlier and 37% a day earlier. This reassessment is supporting the dollar.

From a technical analysis perspective, the dollar index is trying to break the downward trend. DXY has repeatedly tested the 50-day moving average since May. A move up from the current 98.27 to 99 (+0.75%) would be the first sign of a sustained reversal to growth, and this move could happen as early as this week.

The FxPro Analyst Team