We continue to see a rapid recovery in inflation across the Globe. This factor could severely restrict the actions of the Central Bank in the coming months, thus delaying recovery.

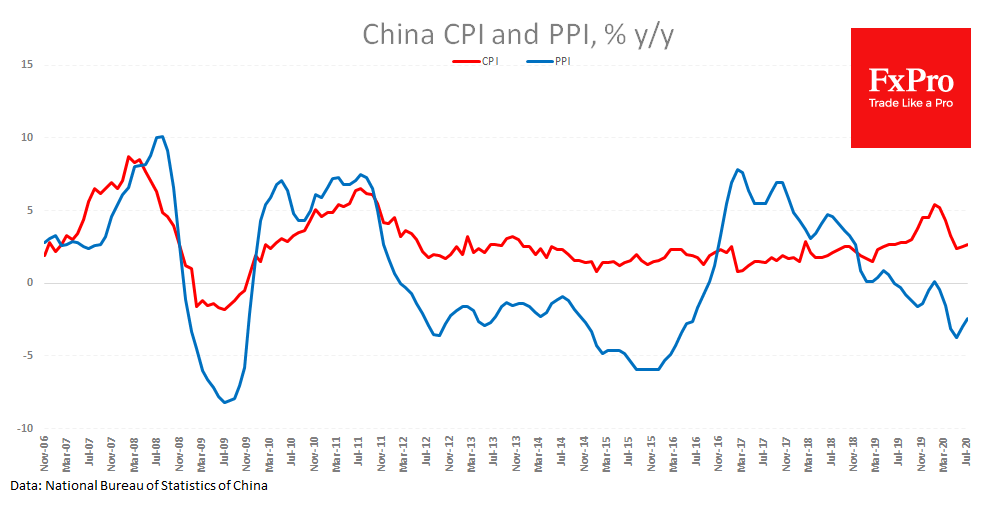

This time, the data from China has exceeded expectations. CPI rose to 2.7% YoY in July, accelerating for the second month in a row despite feeble retail sales (the latest data for June showed a 1.8% YoY decline). An economic slowdown with sharply rising prices is called stagflation, and it risks being a real threat to the world.

This time around, inflation turned to growth earlier and from a higher base than in the crisis of 2008. The distortions of supply chains and consumption caused by the pandemic can easily explain this difference.

The FxPro Analyst Team