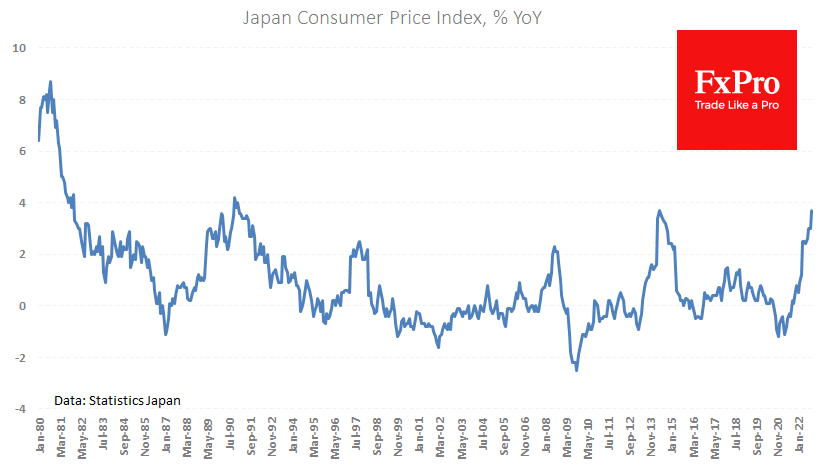

Consumer inflation in Japan accelerated to 3.7% in October, repeating 2014 highs and approaching the peak of 4.2% in late 1990. Excluding fresh food, prices rose by 3.6% y/y, the highest since 1982.

At the same time, price growth was expected to slow from 3.0% to 2.7%, so the difference between expectations and facts looks shocking. The highest price growth since the early 1980s unites the developed nations, going well beyond the price of energy, as was the case in previous years of recent decades. However, in North America, inflation is already on its way down; in Europe, it is likely to peak in November.

This divergence in inflation trends is mainly due to exchange rate movements, where the yen has been the hardest hit. In October, the country’s monetary authorities stood up for the yen (in Japan, currency interventions are the prerogative of the Ministry of Finance and not the Bank of Japan).

Nevertheless, an important fundamental factor weakening the yen was still the policy of the Bank of Japan, which remains the only central bank in the world that keeps negative interest rates.

Although consumer inflation in Japan has been above the central bank target for the last seven months and continues to accelerate, Chairman Kuroda continues to find excuses not to raise rates. In his speech following the release of inflation statistics today, he ruled out a rate hike without accelerating wage growth. This is like the assurances of the ‘temporary inflation’ we heard from the Fed and ECB last year.

The BoJ stuck in the denial phase leaves the fundamental reason for the pressure on the yen, which would probably continue to fall without the support of currency interventions.

The FxPro Analyst Team